Month: July 2016

New Report: Drones in Public Safety and First Responder Operations

It may not seem like it, but drones are still in their infancy and only proving themselves through the rigorous testing done privately, commercially, and by state and federal government agencies. Despite the tangible benefits that drones can provide, the public has mixed sentiments about their use by law enforcement, firefighting, and search & rescue … Read more

QuickTake: Can Kespry Overcome Its Brand Challenge?

Its enterprise drone is fit for construction, mining, and insurance companies, but the question is whether companies already catering to those audiences and adding drone capabilities will win out over this well-funded newcomer. THE FACTS: In June 2016, drone manufacturer Kespry announced the close of a $16 million Series B equity financing round. It included … Read more

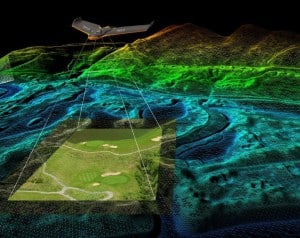

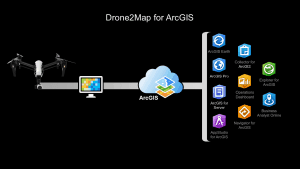

The Truth about Drones in Construction and Inspection

We just released a new research study titled “The Truth about Drones in Construction and Infrastructure Inspection.” The free report is the second in series of studies sponsored by BZ Media that looks objectively at each major commercial market for drones and drone technology. In the report, we show how drones have been used successfully … Read more