Month: October 2016

Why I Think the Prosumer Drone Will Never Die

Innovations will flourish on drones that target the prosumer market for a long time THE FACTS: In the 1980 book, The Third Wave, futurologist Alvin Toffler coined the term “prosumer” when he predicted that the role of producers and consumers would begin to blur and merge. Today, the term is well accepted as a descriptor … Read more

6 Tips for Avoiding Phony Dronie Consultants and Attorneys

How to steer clear of the wrong hire for your drone business By Jonathan Rupprecht, Esq. for Drone Analyst® It seems everyone is running toward the “drone” rush to make a quick buck. The way I see it is many of the consultants and attorneys assisting businesses with drone work are in reality experimenting on … Read more

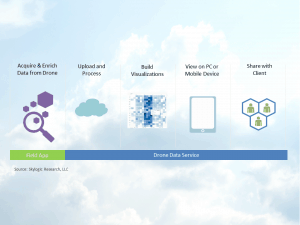

5 Tips for Evaluating Online Drone Data Services

Choosing the right service means choosing a trusted business partner THE FACTS: In early 2014, it was easy to see that drones themselves (the aircraft) would quickly become commoditized and their value would come not from what they could do but from the data they collect. In a piece titled “Drones Revolution Means Big Data … Read more