Month: December 2016

Commercial Drone Markets: 2016 Year in Review

Last year at this time, I reflected back on the news and trends of the commercial drone markets of 2015 and wrote about the mixed state of affairs in the U.S. Back then we saw only 2,500 Section 333 grants for commercial activity, and the press’s narrative that ‘drones are cool’ turned to ‘drones are … Read more

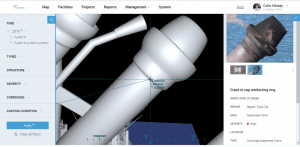

Is Sky-Futures Expanse Drone Inspection Software Good for All?

Sky-Futures cloud-based drone inspection visualization and reporting software squarely targets the asset inspection sector, but will it be broadly adopted? THE FACTS: No one questions whether the founders of Sky-Futures know what they are doing. When it comes to drone inspections they have “been there, done that.” You can read about their history and … Read more

Can AeroVironment Compete in the Commercial Drone Market?

AeroVironment’s new drone and cloud-based analytics platform squarely targets the commercial sector, but are they targeting the wrong vertical, too late in the game? THE FACTS: Earlier this month, the military and tactical unmanned aircraft systems manufacturer AeroVironment (NASDAQ:AVAV) proudly unveiled its new QuantixTM drone and a cloud-based analytics platform called the AeroVironment Decision Support … Read more