Last month, the FAA released its updated Aerospace Forecast (2020-2040), an annual report that updates key metrics behind all aspects of the US aerospace – including U.S Airlines, General Aviation, Commercial Space and UAS.

Last year’s forecast brought widespread attention to the acceleration of the UAS industry, but this year’s forecast mostly went unnoticed as the COVID-19 pandemic has consumed the world’s focus. But DroneAnalyst hasn’t missed it, and we’re breaking down the main insights into the drone industry in our latest report.

Before we get started, it’s important to note that any forecast that relies on data from previous years cannot be relied upon after COVID-19. However, these annual reports also reveal registration and survey data that we have used to build a historical analysis of the drone industry performance.

Scroll through the blog for key insights and click through to download our free report titled “Historical Performance of the American UAS Industry”.

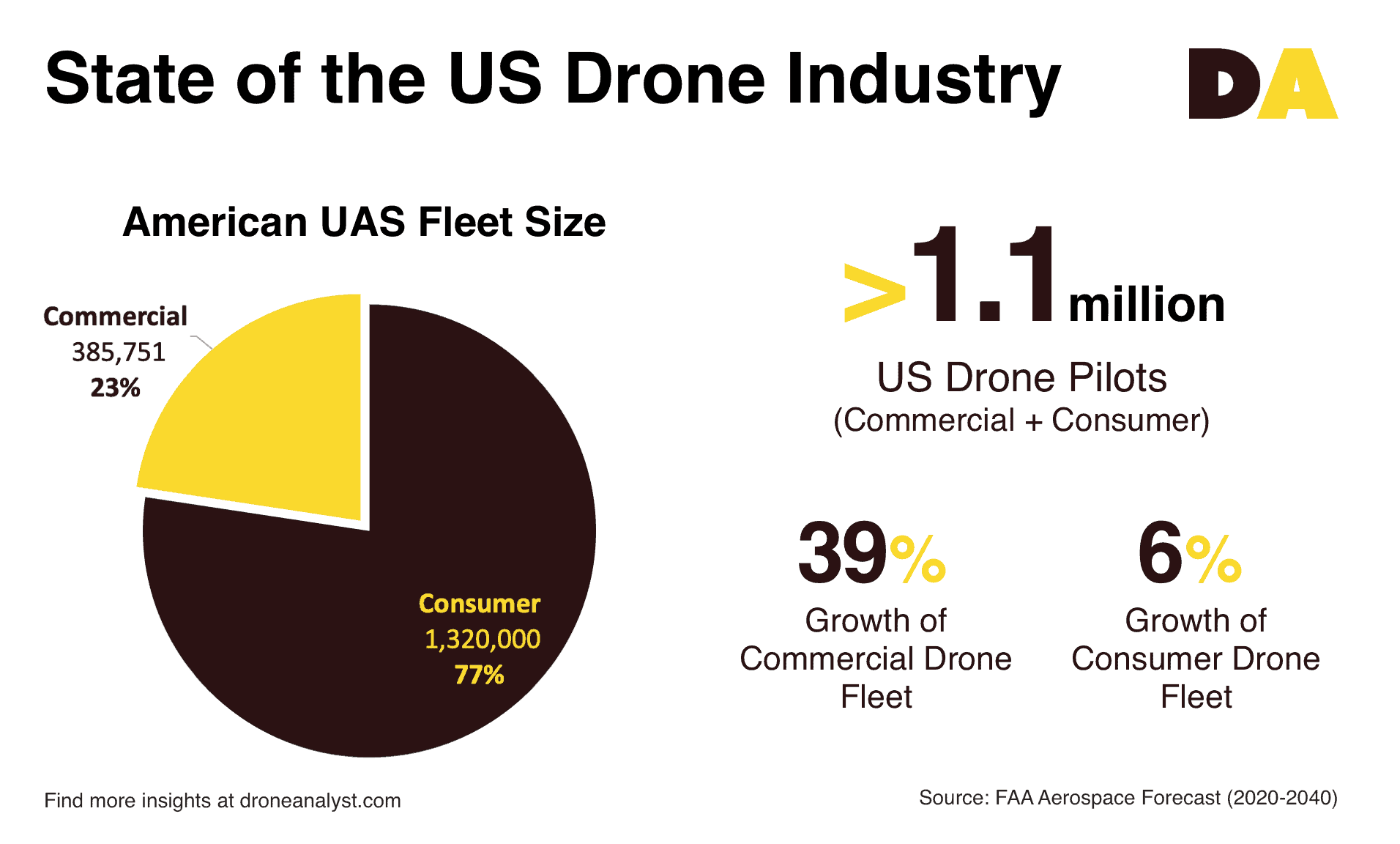

Drone Market Surpasses 1 Million Pilots

2019 saw the drone industry rush past a significant milestone – with more than 1.1 million registered drone pilots in the United States. This highlights the great strides and progress of the drone industry.

These pilots are dominated by consumer aircraft owners, which is just 10,000 pilots shy of reaching 1 million pilots as its own category. We estimate the count of American consumer pilots already surpassed 1 million back in January 2020, before the effects COVID-19.

Consumer Market Stagnates, Commercial Expansion Continues

Despite the industry setting a new record, the 2019 growth rates signal upcoming hurdles. The growth of the consumer drone fleet dropped into the single digits for the first time. Similarly, the commercial drone market is not soaring as fast as it used to – albeit the current growth figures remain impressive around 40%.

These trends combine together to make the American drone industry more commercial focused than ever before. While the commercial sector of the drone industry made up only 5% of the market back in 2016, it is now just shy of 25%.

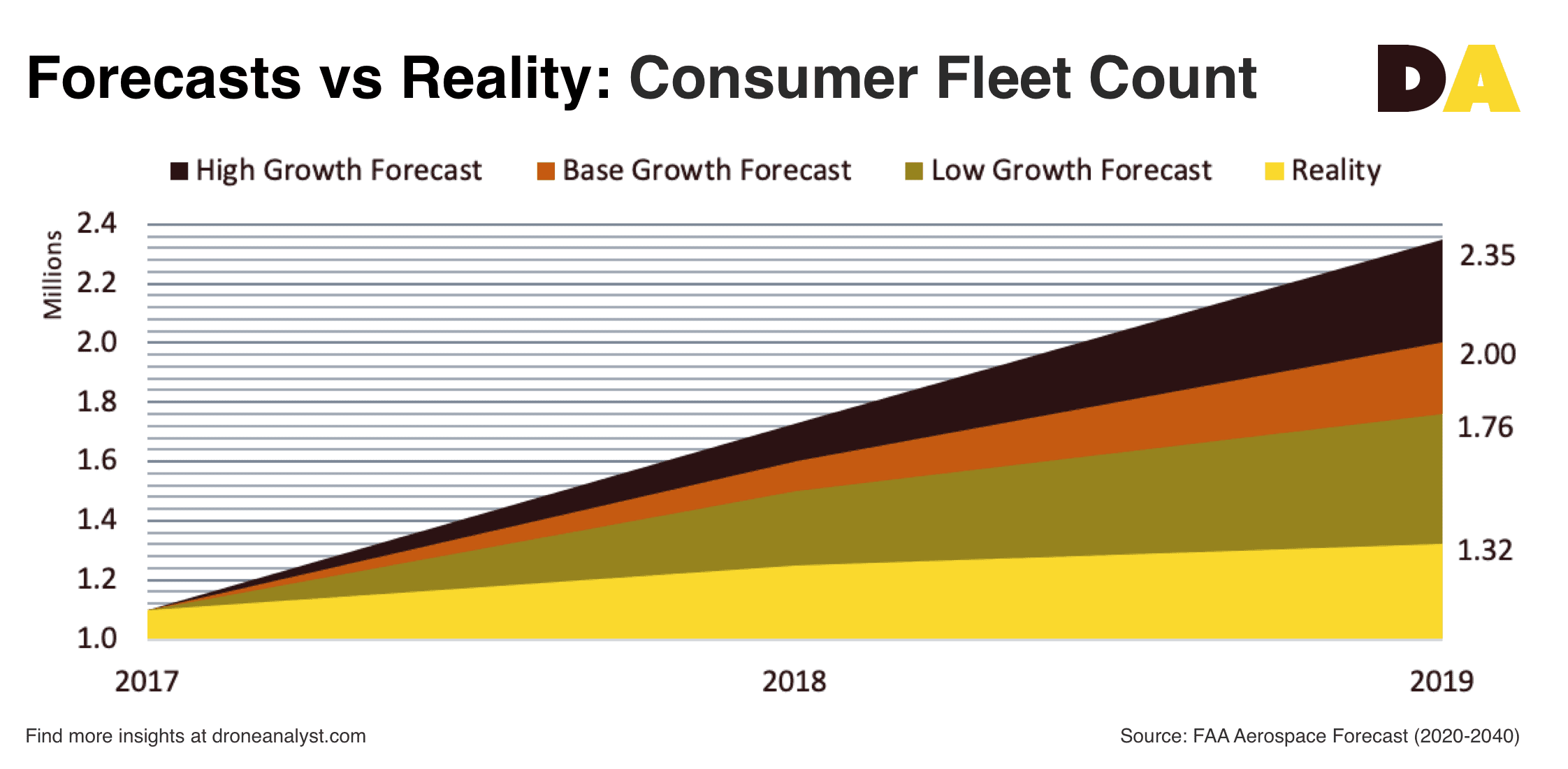

Where Did All the Consumer Drones Go?

Now that we have historical data, we took this opportunity to assess the accuracy of the FAA’s forecasts. This is NOT an attempt to criticize the FAA, but instead to reflect on the expectations and reality of the market.

Our report finds that the consumer drone market is severely underperforming against expectations. While we can’t conclusively say what has resulted in this gap, we will be writing about some potential causes in a future blog post.

Want to dive deeper into the FAA data and understand the historical performance of the American Drone industry? Head over here to download our free report titled “Historical Performance of the American UAS Industry”.

Comments are closed.