Recent Accusations of Fraud Raise the Larger Question about Investing in the Drone Industry

Last week EHang and AgEagle, two companies in the still nascent Advanced Air Mobility (AAM) space, faced fraud accusations by short sellers (EHang | AgEagle). Both stocks have soared over the past year as investors bought into the drone industry hype during a historically bullish market – AgEagle rising from less than $0.5 to nearly $15 and EHang from $10 to $120.

This article won’t look into the specific fraud allegations or offer investment advice, but instead I would like to take this opportunity to elaborate on AgEagle’s situation and business prospects to help close what I see as an information gap between drone industry veterans and the general public.

The drone industry is understandably seen as a new tech space with near-unlimited potential. However, how many perceive where the value of drones actually exists is heavily influenced by the news they read. Media organisations are quick to cover the movements of Amazon’s goal to provide drone deliveries by 2019(!!), geopolitical drama as industry giant DJI is caught in US-China tensions, hype for short-range passenger/delivery drones and, often unconfirmed, sightings of drones near airports.

Put together this may lead the general public to believe the value of drones is in delivering packages or people. That is far from the truth, as the majority of the industry today is focused on professional photography/cinematography or delivering data for businesses and agencies. Drone for imaging applications is a market that delivered over 2 million drones last year, while the delivery and AAM space is slated to receive billions in investments for firms in the test phase with no proven market for their services.

AgEagle is particularly interesting in telling this story of disparate worlds between the drones that investors envision and what is the market today. AgEagle began as a hardware/software play in the agriculture imaging market before more recently pivoting to the much hyped drone delivery space. We’ll take a look at AgEagle’s business, what concerns we have, and lastly what the broader ramifications are for the industry.

A Look at AgEagle’s Legacy Business

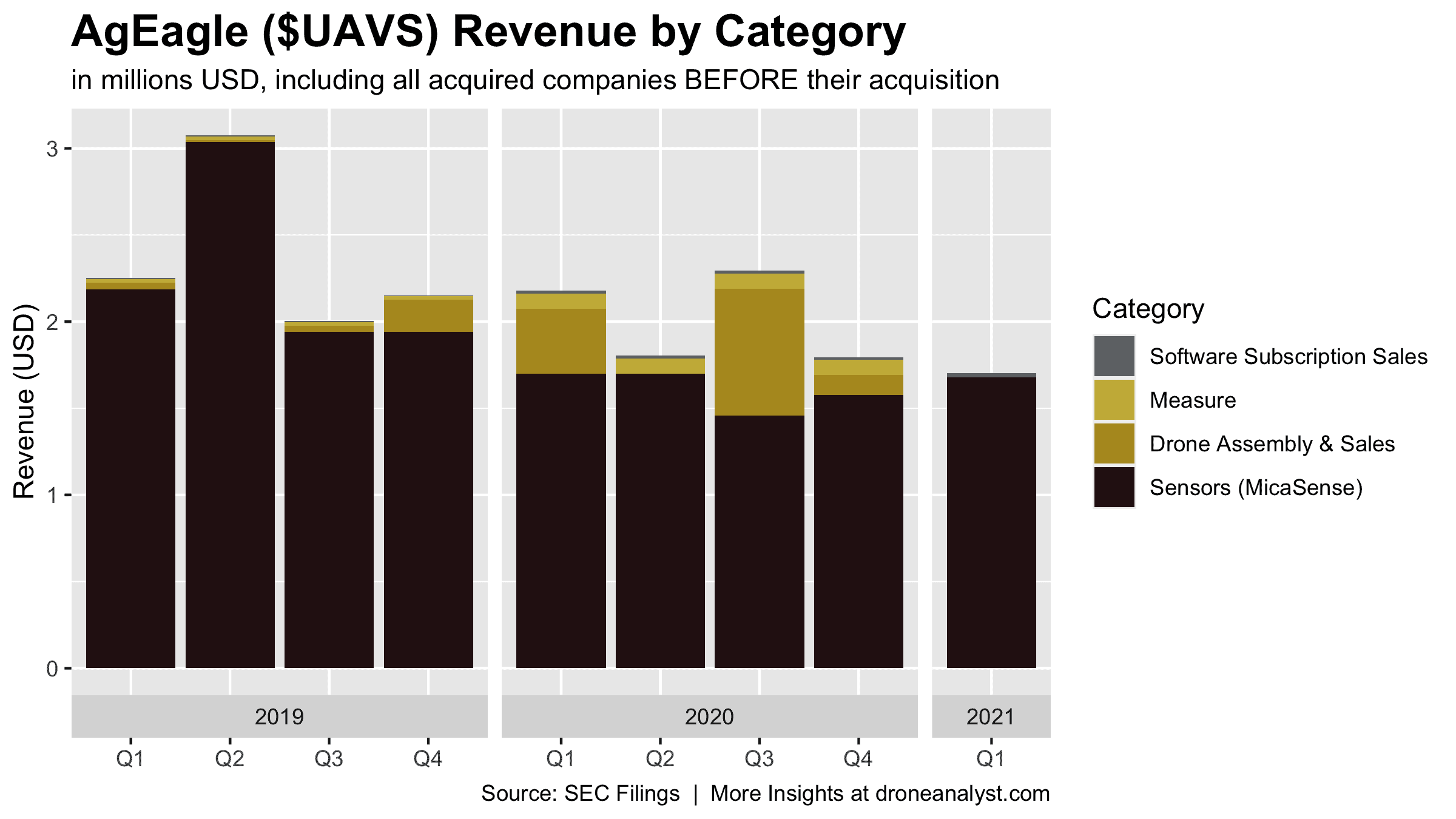

AgEagle has been trading at 700-800x its annual revenues, with a market cap surpassing $900 million before the fraud allegations. At the same time, AgEagle has used its newly acquired market cap to go on a buying spree, acquiring two long-time drone businesses – Measure and MicaSense.

This means traders believe AgEagle has the potential to grow to make hundreds of millions in just a few years, allowing for further growth of their investment. While 2020 has proven to be a pivotal year for the company as their drone manufacturing business shows signs of growth, we are still talking about a business that was just below $1.3 million in revenue last year. Even worse, their recent 2021 Q1 filings show poor performance in their legacy businesses, which we show below. It’s important to note this does not include their recent acquisitions, which we show later in the article.

While we originally saw the huge uptick in Drone Assembly & Sales revenue in 2020 as a sign that the company would be headed in that direction, the recent downtick in the category and new acquisitions point elsewhere. It does continue to raise the question of just who they are assembling drones for, and why that hasn’t taken off. We have seen their previous investment in and exclusive manufacturing agreement with last-mile drone delivery mailbox developer, Valqari, but based on their filings and my discussion with Valqari’s CEO on LinkedIn, they are not AgEagle’s main manufacturing customer in 2020.

Recent Acquisitions

So, if their legacy business isn’t taking off, let’s dive into their recent acquisitions. MicaSense and Measure both have long histories in the drone space. From our 2020 annual report, we found that MicaSense was far and away the leader (market share by units) in the multispectral sensor segment. I cover more about MicaSense and some issues with the intent of the acquisition in the next section.

Measure has had a more complicated history, beginning as a service provider before selling off its services business to focus on its Ground Control software. This pivot happened at the end of 2019, so their software hasn’t had much time in the market as their core focus. That is reflected by their financials, with roughly $350,000 in revenues in 2020.

When we put the work of MicaSense, Measure and AgEagle’s legacy businesses together, we can better understand that MicaSense’s sensor sales are AgEagle’s core stable business line.

Our Concerns

Issue 1: Micasense Acquisition

On January 27, 2021, AgEagle announced their acquisition of MicaSense from the Parrot Group for $23 million. Initially this makes sense. According to our 2020 Drone Market Sector Report, MicaSense has been the leading brand in the multispectral drone sensor niche for agriculture, which would easily compliment AgEagle’s focus on agriculture. Even better, MicaSense has healthy, stable revenue sources, beating out AgEagle’s annual revenue in any single quarter over the past two years.

However, despite their name, AgEagle is now focused on package delivery drones. And their CEO’s statement about the acquisition makes this very clear.

With the onboarding of MicaSense’s powerful imaging technologies onto a drone designed for package delivery, we believe it will enable us to produce a turnkey solution that processes in-flight data in real-time. This will allow for drones to effectively assess emergency landing zones, confirm and substantiate successful deliveries and determine proximity warnings, among other important considerations.”

J. Michael Drozd, AgEagle CEO on their acquisition of MicaSense

Now that sounds like a good fit, right? No, this makes no sense at all once you actually consider the technology involved. Multispectral cameras – such as those made by MicaSense – are impressive technology. With drones they are most often used to created detailed vegetation maps that provides insights that traditional photography just can’t. However, MicaSense has little to do with developing obstacle avoidance cameras for drones.

Instead, we have mostly seen combinations of wide-angle visual cameras, ToF sensors, ultrasonic and/or LiDAR sensors for obstacle avoidance. This all comes together with sophisticated software to identify objects and distances in real time. None of which have been MicaSense’s focus, or AgEagle’s.

#2 The Crowded Delivery Space

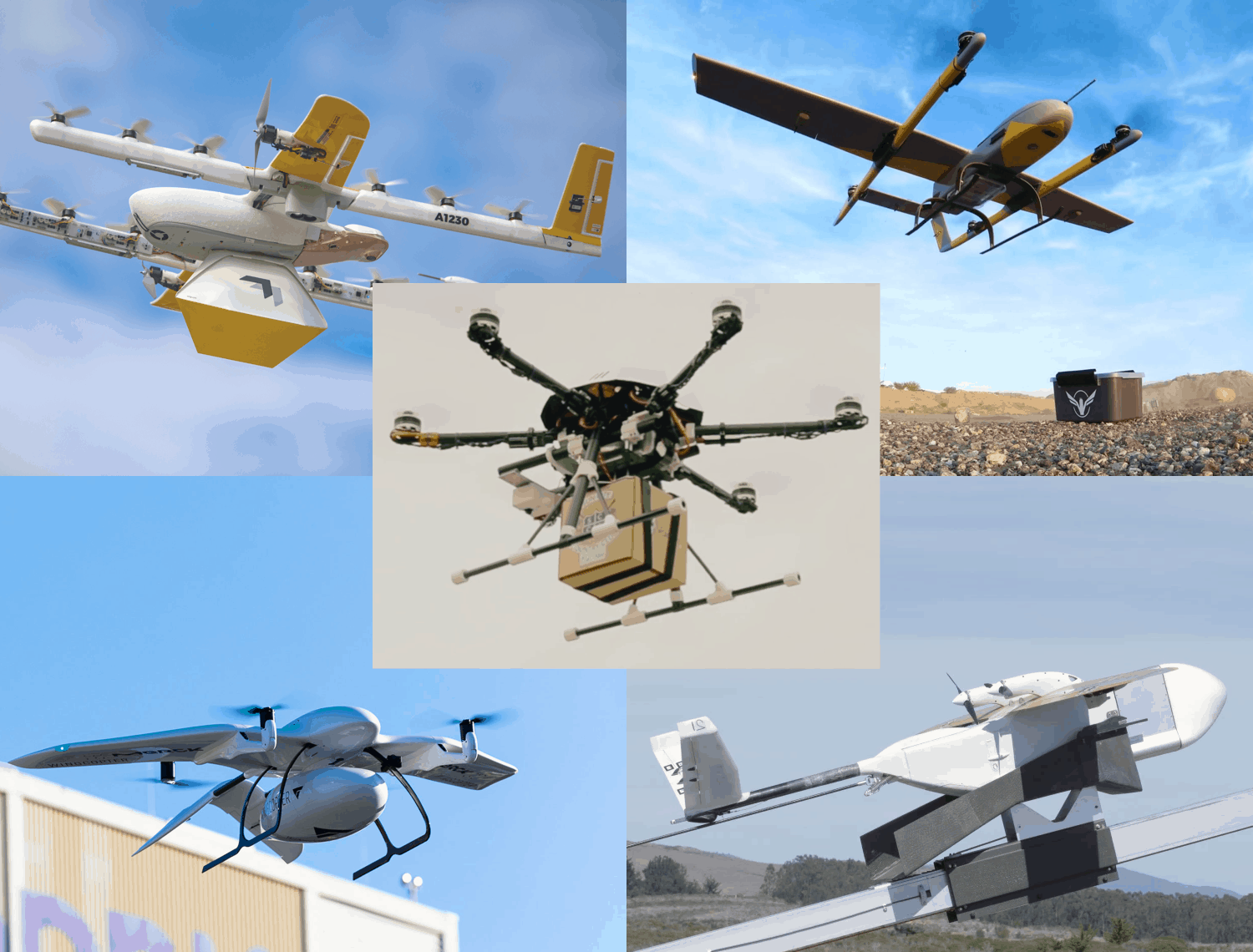

AgEagle is competing in the hyper-competitive drone delivery space, with Alphabet-backed Wing, Zipline ($230m), Volansi ($75m) and Wingcopter ($22m) to name just a few of the highly capitalised firms in this space. These companies understand it will be a long-haul, with the FAA having just updated the type certification process, and published criteria for 10 companies (who can be seen as leading in the space) last November.

As part of these guidelines, manufacturers will not just need to prove that their design is safe and meets performance-based standards, but have a track record to back it. That is why scale of active deployments is so critical.

While I don’t see the drone delivery space as a winner-take-all market, each of these companies will be hard pressed to find their niche in the market. It is very easy to see who is spending money to develop and improve their product and manufacturing capability (and who isn’t) by taking a look at a lineup of the drones below.

What this Means for the Drone Industry

Put together, I see this as sign that investors are looking to buy into the drone industry, but don’t have many options. This is changing as VC investment has returned to the drone industry, which will pressure firms to eventually enter the public market and we have high profile SPAC entrances coming for firms in the AAM space.

There is a rich grouping of successful and expanding drone businesses in the drone imaging market. While the hardware segment still has a lot of hurdles to climb before any competitor rivals DJI, the software and services market has a selection of viable and growing organisations. This includes DroneDeploy, DroneBase, KittyHawk, CyberHawk and more. In fact, Measure, a drone software firm with large clients including Skanska, US Air Force and LAPD, has recently announced plans to go public.

While investors may see the imaging drone market to be a stagnant niche, we’ve seen this segment continue to steadily grow. While this segment may never be as publicly visible as drone delivery or transportation, it produces solutions that are already deployed by Fortune 500 firms such as ExxonMobil, Berkshire Hathway’s BNSF, Marathon, AECOM and more. Spending on drone imaging programs has yet to explode, but we do expect the rate of spending to increase significantly moving forward. We explore the trend of how drone programs have formed “from the bottom up” at enterprises and the ramifications in a recent article.

Most importantly, the commercial drone imaging market will work as an entrance into the broader commercial robotics market for industry stakeholders and investors alike. The partnership between Boston Dynamics and DroneDeploy to integrate drone and ground-robot data together was the first sign of the synergy between these spaces. A core application for ground robots will be data acquisition, and as that market segment matures, it will be a growth market for drone software and services businessses.

For investors, this means to stay calm, focus on the fundamentals and understanding the landscape. All types of drones will rise in the future, but it won’t be a straight path. Anything that flies is inherently working in a regulated market, and will often compete with ground technologies. There is a 100% likelihood of drone delivery or transportation being more common than it is, but it isn’t guaranteed to replace or supersede all other technologies in its way. The landscape, and company fundamentals are important.

Where to Find More Insights

- Understand recent regulations from the FAA on Remote Identification.

- Learn how DJI’s drone dominance was born, the consumer market faltered and may rise again.

- See how COVID-19 has increased interest in consumer drones.

- Understand the four forces that shaped the drone industry in 2020.

very helpful information. thanks for your time.