DJI Moves to Sell Its Enterprise Drones Online, with Impacts to the Broader Drone Ecosystem

Last Friday, DJI reversed direction and moved to sell much of its enterprise products online. DJI had previously exclusively sold its powerful, expensive and complicated enterprise products solely through distributors like RMUS, DroneNerds, Heliguy and more, with over 100 US-based distribution partners in late 2018, and we estimate roughly 200 globally.

This shift in channel strategy by the industry’s sole dominant hardware provider (at a 69% market share globally) will have serious repercussions across the industry, as dealer margin on DJI’s enterprise products brought an estimated $180 million in 2020 to local distributors around the world.

A Look into the Business of Drones

While consumer drones like DJI’s Mavic Mini have always been available online and at popular retailers like Amazon and Best Buy, most commercial drone sales are done through distribution partners. This is critical as these products tend to be more complex and require additional knowledge to address a client’s specific needs.

This value-add nature of local distributors has been of a great benefit to DJI as it has helped scale out their sales, marketing and support staff without needing to directly hire staff around the globe. To support this symbiotic relationship, with the launch of the Matrice 200 Series DJI began to solely sell its enterprise hardware through distribution. Additionally, DJI has boosted distributor margins for these products over time, increasing on average by 10 points in the past two years. This has led to many distributors around the world to slowly shift their business from the consumer drone market to the commercial one, hiring staff that can assist enterprises and public agencies in scaling out drone operations.

One drastic example of this transformation is Italy’s Hobby Hobby, which – as the name suggests – started as a hobbyist drone retailer. As they saw increased margin in the enterprise segment they incorporated a separate brand called “Elite Consulting” to both sell DJI’s enterprise hardware and offer its own training.

Other distributors such as RMUS have gone above and beyond just education on products, building out a training curriculum that covers drone program management and niche, technical topics like thermography.

Shifting Tides

This change in DJI’s sales strategy comes after a surge of increasingly positive shifts for drone distributors that had recently seen increased margin for DJI products and improved enterprise hardware that incentivise commercial customers to purchase enterprise-grade hardware instead of consumer-grade ones with less margin.

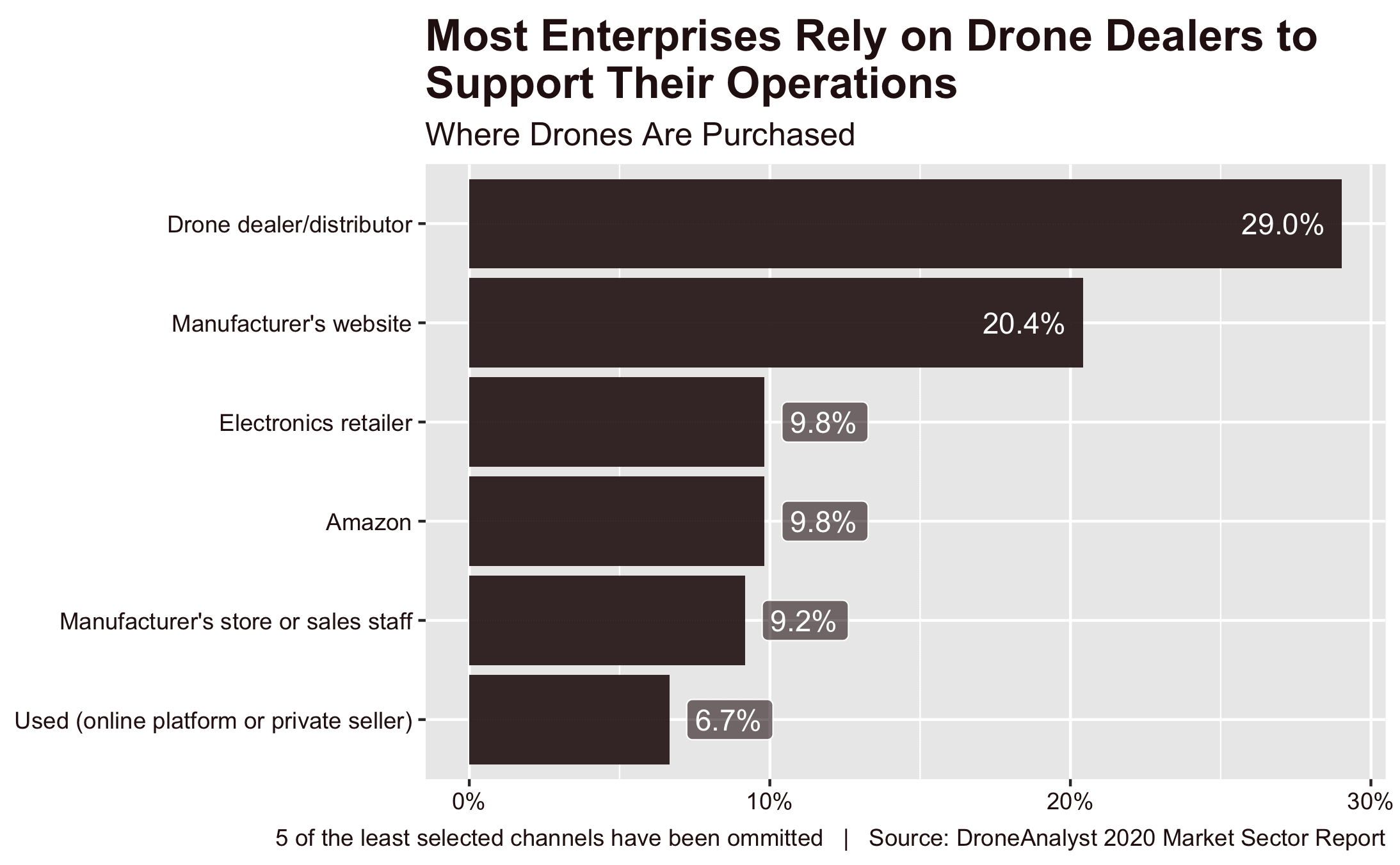

Put together, these previous trends have seen a surge in drone distributor’s share of overall drone sales, as shown below.

We’ll track how this trend shifts in the coming years as DJI’s online store starts to compete with its distribution partners.

Overall, we don’t see DJI’s online store being competitive against local distributors in the long run, as DJI has few (or none in most regions) local staff to support the customer after initial purchase. Distributors are also able to proactively bid on projects and package in additional services that would incentivise a purchase.

In a response to our question on support, DJI indicated that its support for online enterprise hardware sales will be in-line with that done on their hobbyist and professional gear.

Impact on the Market

Ultimately it is up to DJI to decide how it sells and supports its products, and if it decides it wants to compete with its distribution partners, that is well within its right. At the same time – due to DJI’s leadership position – these decisions will have widespread impacts on other industry stakeholders that need to be considered.

The largest impact will be seen on the behaviour and profits of distributors. Generally speaking, DJI’s online store will work to squeeze distributors who provide little value-added services and keep DJI products in contention while many start to consider diversifying their drone fleets.

When asked about the rationale behind this decision, DJI first noted that this is primarily a way to meet the increasing demand for its products “in the most flexible manner”, and added:

Our existing DJI Enterprise dealer network has built a strong global reputation as solution partners by offering services, advice and consulting with every drone they sell. Their expertise is invaluable for first-time customers just entering the drone era, as well as for experienced operators who have developed close and responsive relationships with their dealers. DJI is listing Enterprise products online without discounts, at the same price recommended for dealer sales – preserving their ability to negotiate prices directly with customers and respond to bidding opportunities.

DJI statement on why it moved to sell its enterprise hardware online

From our conversations with DJI’s distributors, DJI strongly enforces a unified pricing policy that punishes dealers from discounting their hardware, as suggested in DJI’s statement. Often distributors are forced to cut prices on additional software or services on competitive bids.

Likely this shift is an attempt to capture follow-up purchases from clients currently purchasing from their distributors. This inherently diminishes the benefit of distributors finding net new clients, as they may not share in the profits of this customer’s future purchases. Why spend on marketing activities and business development if a customer will only later choose to buy follow-up drones from DJI’s online store? Instead, it may be smarter to invest in value-added services – which can be discounted – to secure follow-up purchases and improve customer relations. But then who fits the bill for finding new enterprises to deploy drones?

The impact on distributor investment becomes a larger issue for dealers in Europe or elsewhere, where their business tends to be primarily driven by consumer drone sales, with enterprise drone sales as a small, growing segment of their business. DJI holds many levers over their business, easily able to take away access to DJI’s consumer drone products if they explore competitors, and is now likely to impact their profitability by eating into follow-up sales of enterprise drones. With this new threat in mind, how willing will these distributors be to continue investing in the enterprise market? It may be more profitable to act as a passive player instead of investing in new activities that capture new customers.

On the other side of the equation, if DJI were investing these increased profits into further expanding the market, we might see larger benefits to this approach. While DJI’s enterprise marketing department has invested in consistent online educational content on its Insights platform, we have also seen DJI withdraw from investing in staff to support the market growth on the ground. Recent reporting from Reuters found that DJI lost one-third of its US-based staff in 2020, and had a larger cut globally to its sales and marketing operations, including the closing of its entire sales and marketing operation in South Korea.

For full disclosure, the author of this article had previously worked at DJI and led the team behind DJI’s Insights platform.

Good for Profits, Bad for Politics

In the past, DJI has defended itself from attacks by regulators seeking a more competitive market by showcasing the size of its ecosystem partners and the opportunities it creates for firms across the world. There is a lot of truth in this story, with many leading software developers and system integrators developing unique solutions on DJI’s affordable, powerful and modifiable software. However that may be changing, as in addition to now competing with its own partners in the channel, DJI last week notified its developer partners that it is pausing key aspects of its iOS SDK, often developer’s preferred platform. This comes after several attempts to compete with its developer partners by deploying similar hardware and software. It begs to question how regulators may see DJI’s net impact on their economy in the future, as DJI increasingly tries to capture the entirety of the drone revenue chain while reducing staff and marketing investments.

This may be particularly critical considering DJI’s addition to the US Commerce Department’s Entity List. With a new administration and Secretary of Commerce in office, this will be a critical time For DJI to lobby for removal from the List. These decisions will have an impact on whether or not its US partners show up to the Hill by their side.

Where to Find More Insights

- Dive into the new US Drone hardware ecosystem

- Understand recent regulations from the FAA on Remote Identification.

- Learn how DJI’s drone dominance was born, the consumer market faltered and may rise again.

- See how COVID-19 has increased interest in consumer drones.

- Understand the four forces that shaped the drone industry in 2020.