Despite geopolitical tensions and security concerns, the drone industry’s reliance on DJI remains firm. We explore why.

While headlines have focused on DJI drones being “banned” or “blacklisted” from the US market, many following the industry will know just how little impact these US government actions have had on the majority of drone sales and DJI’s market dominance. While it is worth going into the nuances of DJI’s Entity List addition – which is not a ban – we are focusing this article on how DJI has reacted and the role it plays in the industry.

Despite heightened pressure and focus on DJI, it has continued to behave in the most “DJI” fashion – having launched its first FPV drone, introduced the $999 Air 2S to compete with its own $1600 Mavic 2 Pro and pushed into the EV automotive rush. On the commercial drone side, DJI has started to ship its Mavic 2 Enterprise Advanced drone and L1 and P1 surveying payloads that were launched shortly before their Entity List addition toward the end of December 2020.

DJI’s Market Position

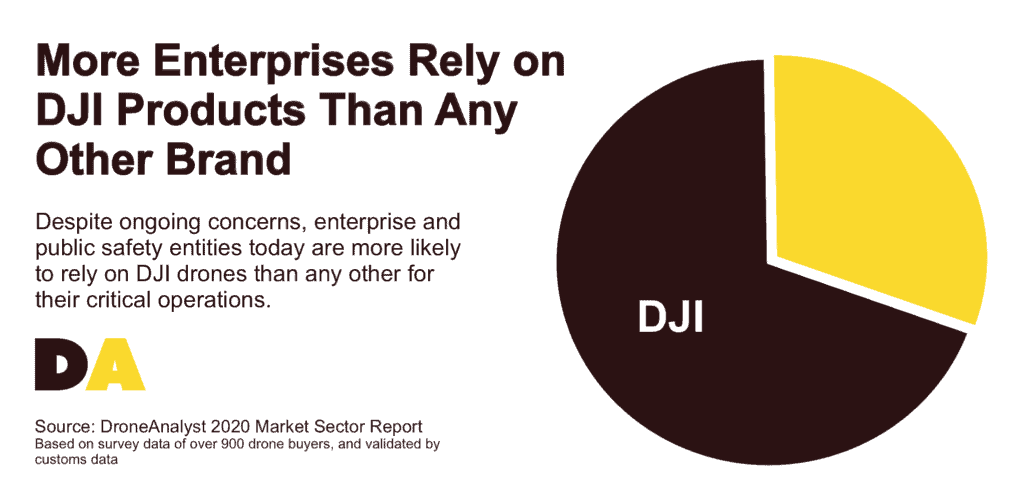

All this normal DJI behavior emphasizes the fact that DJI products are still available, and DJI is still the most-selected brand in any drone segment that it participates in.

While much attention has been paid to how the Entity List addition may influence enterprise customers, we have yet to see a large impact. The apparent reason for this is that DJI products are best suited to address the motivations behind drone purchases, and most market segments lack real alternatives.

The large number of new entrants with all-in-one dual thermal/RGB imaging drones underscores the lack of real alternatives in other segments. With five Blue sUAS entrants – Skydio, Vantage Robotics, Altavian, Teal Drones and Parrot – in addition to Autel’s Evo II Dual and Brinc’s Lemur, this space is getting crowded. However, many of these firms continue to struggle to reliably deliver units, continue to rely on Chinese components and (except for Autel) are roughly 2x the price of a Mavic 2 Enterprise Advanced. And this is the only segment where DJI faces significant competition, as competing brands struggle to compete with DJI’s larger M300 enterprise platform, dedicated surveying offerings (P4 RTK) and more affordable consumer offerings (Mavic Air 2, Mini 2). The competitive landscape can be viewed in the figure below.

| DJI Product | Segment | Price (USD) | Competition |

|---|---|---|---|

| Mini 2 | Consumer | <$500 | None |

| Mavic Air 2 | Consumer | $800 | None |

| Mavic 2 Pro/Zoom | Prosumer | <$2,000 | Strong: Autel, Skydio |

| Mavic 2 Enterprise Zoom/Dual | Enterprise | >$3,000 | Strong: Autel |

| Mavic 2 Enterprise Advanced | Enterprise | $6,500 | Strong: Altavian. Autel, Brinc, Parrot, Teal, Skydio, Vantage |

| Phantom 4 RTK | Enterprise | $6,200 | None |

| Matrice 300 RTK | Enterprise | >$13,000 | Nascent: FreeFly, Inspired Flight |

| Matrice 600 Pro | Enterprise | $5,700 | Nascent: FreeFly, Inspired Flight |

Talking about DJI’s market domination through competition in narrow product categories belies its true market position. When we look at the market from a unit sales perspective, the product segments where DJI faces competition make up less than 20% of their sales (by units). Truthfully, DJI has invented the majority of these product categories themselves, and it will take time for youthful competitors to catch up and compete across every segment.

Why Customers Choose DJI

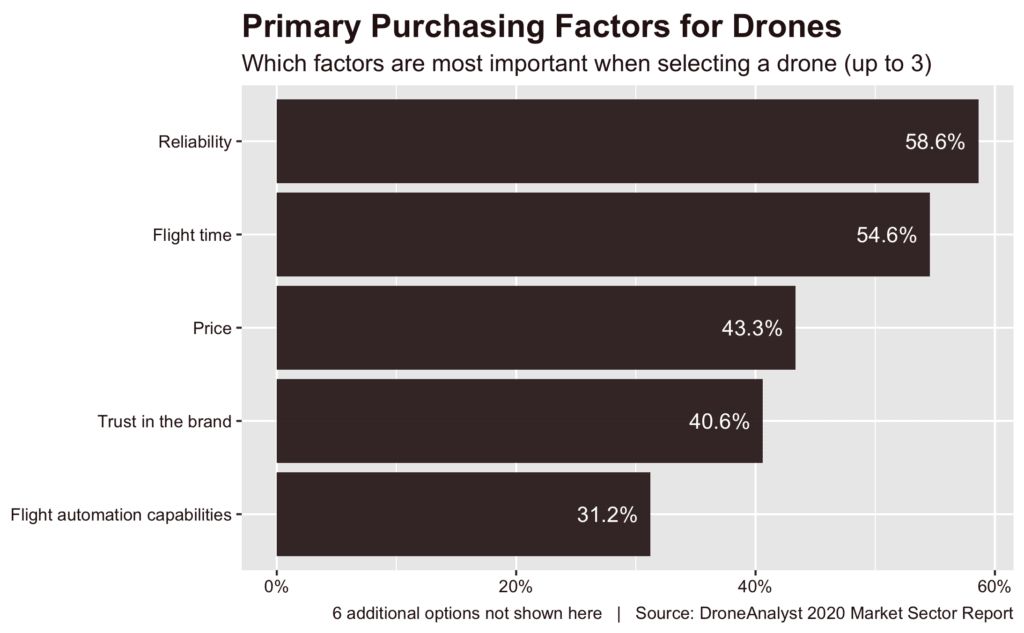

This brings us back to why customers choose DJI in the first place – its products simply best address the reasons users buy a specific drone. We are still in the early days of the drone industry, and purchasing factors match that. Customers that we surveyed in our 2020 Drone Market Sector Report selected Reliability, Flight Time and Price as their top three purchasing factors, reflecting that drones already provide value but organizations need to get units out there to expand operations safely, reliably and in ways that don’t require heavy investments. This last emphasis on cost is critical when considering that drone programs have primarily begun from the bottom of an organization instead of from heavy management buy-in (and spending), and other platforms such as the five Blue sUAS can cost three to five times as much as a comparable DJI platform.

Intriguingly, customers chose “trust in the brand” as their fourth most important purchasing factor over things like flight automation, payload capabilities, data security and more. While industry outsiders may see this as a weak point for DJI due to their Entity List addition, the state of competitors mean that customers’ second or third choice are often younger companies with unproven capabilities.

Security Fact, or Security Fiction?

This similarly takes us to concerns about DJI’s security practices and claims made about the security of data captured by DJI drones. We have long seen general concerns from agencies such as the DHS (US Department of Homeland Security) and other US agencies about drones made in China, which led to the grounding of fleets from 3DR, DJI and others by the US Department of Interior and US Army and seen heightened restrictions across Japanese governmental agencies.

Despite these bans and concerns, there is no public evidence that DJI is purposely or intentionally conducting espionage with its products or installing backdoors. To the contrary, there are several reports and audits by cybersecurity experts and US government agencies that have found no evidence of inappropriate data transmission. We provide an overview of the more recent reports and links to the full reports below.

| Title | Performing Org | Products Covered | Publication Date | Findings |

|---|---|---|---|---|

| DJI Cybersecurity Assessment | FTI Consulting | DJI M210 RTK, P4 RTK, Mavic 2 Pro, Mavic Mini and most software applications | September 2020 | “…DJI offers options for configuration and operation that can both reduce and eliminate the generation and provision of data externally.” |

| Risk Assessment: Detailed Report and Mitigation Plan | Booze Allen Hamilton, PrecisionHawk | DJI M600 GE, Mavic 2 Pro GE, Mavic 2 Enterprise | Updated March 2020 | “Similar vulnerabilities are consistent on other platforms, and not specific to any individual manufacturer” |

| Aviation Cyber Initiative UAS Information Security Risks Limited Scope Test & Evaluation | INL, a US DoE National Laboratory operated by Batelle Energy Alliance | DJI: M600 GE, Mavic 2 Pro GE Parrot ANAFI Autel Evo | October 2019 | “No data leakage was found during the limited-scope analysis” |

| DJI UAS Mission Functionality and Data Management Assurance Assessment | US Department of Interior’s Office of Aviation Services | DJI M600 GE, Mavic 2 Pro GE | July 2019 | DJI’s GE solutions provided reasonable mitigations for non-sensitive missions |

That doesn’t mean that DJI hasn’t had serious cybersecurity blunders that raise doubts – as large, established companies have done similarly. But when you get into these blunders, they tend to be explainable by understanding that DJI has only been a large enterprise for 6 – 7 years. DJI primarily understands consumer products and is still building knowledge about how to meet enterprise or government-grade needs.

Our previous findings have shown that over a quarter (27%) of all drone buyers were impacted by these security concerns about Chinese-made products. Of those impacted, they were more likely to slow or pause purchases instead of buying alternatives – signifying that DJI and the industry are feeling the impact of security concerns.

What is fact or fiction caused by heightened political concerns resulting from the US-China tech war remains a question. Regardless, DJI has reacted by beefing up its security practices.

From our 2020 report, we asked drone buyers what security features are necessary for a product to have before a purchase is made. While the most selected option was that they have no security requirement – suggesting general education on security requirements are low – when you start matching responses to DJI’s enterprise features or specific deployment methods of their products, they address all but one concern.

Broadly this shows that DJI is secure enough for most operators. However, these findings shouldn’t be taken in isolation, and we’ll be digging deeper into where vendors stand in regards to security features in the coming months. In some areas we have seen innovation by new hardware players – notably Skydio and Parrot with their encrypted onboard storage – although many of these new players have not faced as much scrutiny and third-party testing. While this is reasonable considering these firms’ market positions and time in the market, these brands and government agencies should pay as much time to validate that their software is secure as DJI has done, or even more as their focus centers around military customers.

Putting it Together

In totality, while DJI’s market dominance may not be wholly sustainable or healthy, it is clear why it has been so strong in the years prior. DJI offers and continuously releases new products that have a better price, performance and accessibility than nearly everything out there.

At the same time, many competitors have struggled to deliver or catch up. While this fact is changing – particularly due to investment by the US military – it is important for industry insiders and outsiders to acknowledge the value that DJI provides the industry. It is easy to pin the blame for the market’s underperformance against forecasts or general size on DJI, but no competitor has done better.

If you’d like to learn more about the size of the drone market, or DJI’s revenues, read our research on the size of the drone market.

Where to Find More Insights

- Dive into the new US Drone hardware ecosystem and trends among the US Military UAS fleet

- Understand recent regulations from the FAA on Remote Identification.

- Learn how DJI’s drone dominance was born, the consumer market faltered and may rise again.

- See how COVID-19 has increased interest in consumer drones.

- Understand the four forces that shaped the drone industry in 2020.