How much can commercial drone pilots make? What industries pay the most? And more.

Improvements in drone products and regulatory changes have caused a wave of photographers and other professionals to become commercial drone pilots. This may mean joining a services firm or going at it alone as a “droneprenuer”. The rise of drone service providers in the early days saw a few “winners” scaling to form larger DSP businesses (CyberHawk, SkySkopes, DroneBase, etc), while others have turned their piloting skills into a profitable small business.

However, that is not always the case. There have been significant pressures being put on service providers. Aloft’s Joshua Ziering put it well in an earlier article, with many of these trends boiling down to low barriers to entry, and enterprises slowly moving drone operations in-house.

But the question remains, just exactly how much money are DSPs making, which industries are the most lucrative and how do pilot networks factor in? We pull apart data from our 2020 survey to provide some insights below.

How Much Do Drone Service Providers Make?

We asked 468 drone service providers questions about their drone operations, revenues, challenges, and expectations. Our respondents tend to be made up primarily of small service providers, with more than half being a sole proprietorship, and 20% of those as a part time business. The survey also collects respondents from larger DSPs, but they made up less than 10% of respondents.

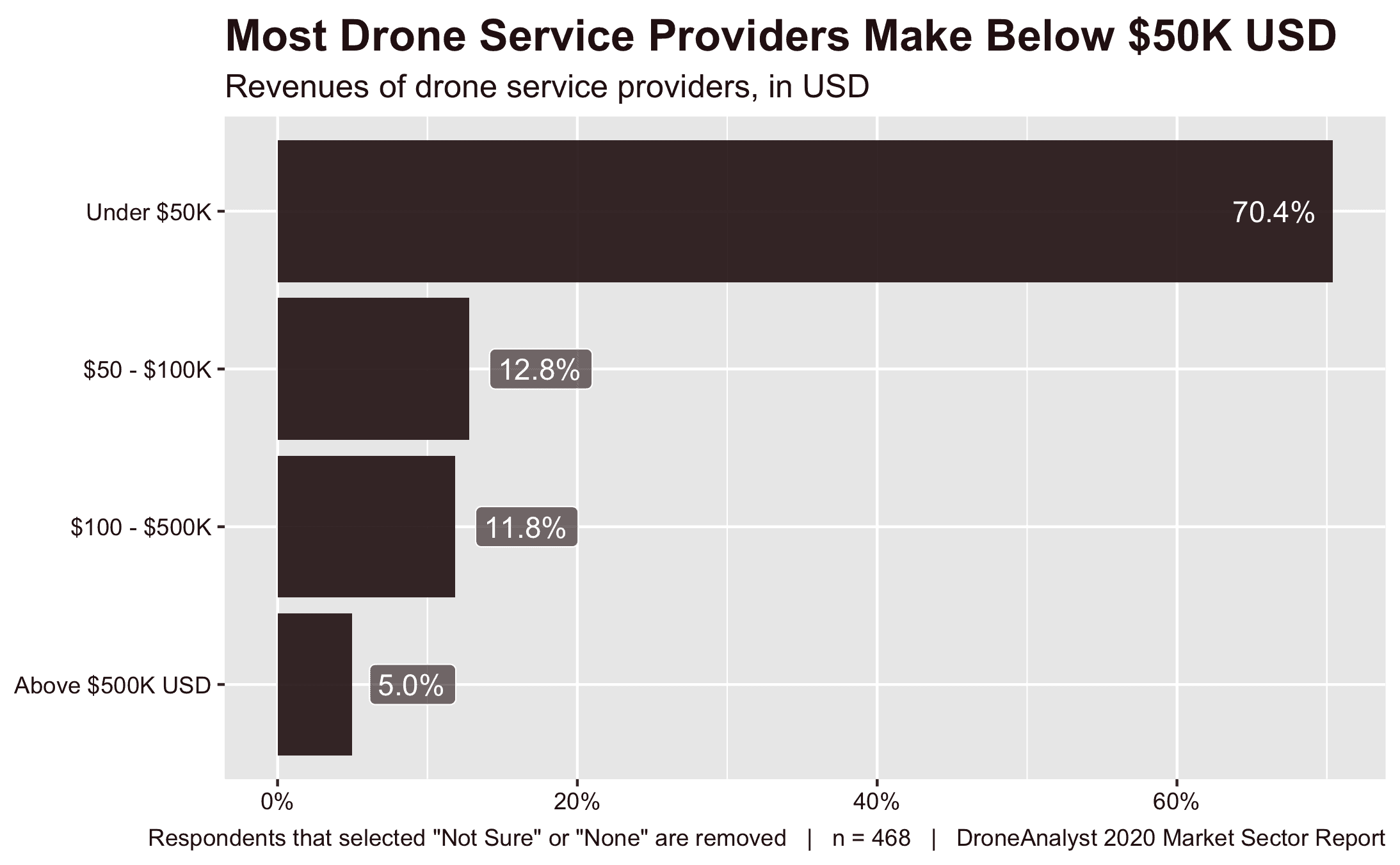

The most telling question has always been how much revenue drone services can provide. A graph of responses is provided below.

The vast majority of service providers made less than $50K USD, below the $68K median household income in the US. What is more concerning is this figure hasn’t moved much over the years. The same question in 2018 revealed that 78% of DSPs made below $50K. So our 2020 data shows some improvements, mostly in the 100 – 500K field, but not a major shift.

At the same time, we have seen the prices of drones purchased for commercial purposes increase over the years, as brands have segmented products to charge higher prices for commercial users. Putting this together, we have certainly seen commercial pilots get squeezed.

We speculate that shifts in our survey demographics (younger and from drone programs themselves) also suggests that a few of our respondents in prior years making under $50K have left the industry entirely to retire or enter another industry. But survey data isn’t a great factor to measure market exits, so we’ll leave it as speculation.

Identifying the Right Industry

So if you are looking to become a commercial drone pilot, or looking to pivot in your service offerings, just what industries are likely to net over $100K in revenues?

Below we provide a table looking just at what services survey respondents making over $100K provided.

Top 3 Drone Services Making Over $100K/Year

- Surveying, mapping, etc

- Aerial photography and/or videography

- Utilities infrastructure inspection or monitoring

We have seen Surveying and Mapping rank at the top of this list since we started collecting data back in 2016. That makes sense considering the complexity of capturing highly accurate data, and often specific hardware and software to enable high-value deliverables.

Aerial photography and/or video is a general catchall, but is mostly speaking to creative applications. Many in this sector will have experience working with ground-based cameras, and likely a lucrative client list from their past work.

Lastly, we have Utilities Infrastructure Inspection/Monitoring, which swapped places with Aerial Photography and/or Video. This makes sense considering Utilities firms are also the industry’s largest spenders on drones, drone software and services. However, this income source will be impacted by these firms internalizing much of their drone operations. While that could be a threat to a service provider, they may also be at the top of the hiring list for these firms in the years to come.

The Role of Drone Pilot Networks

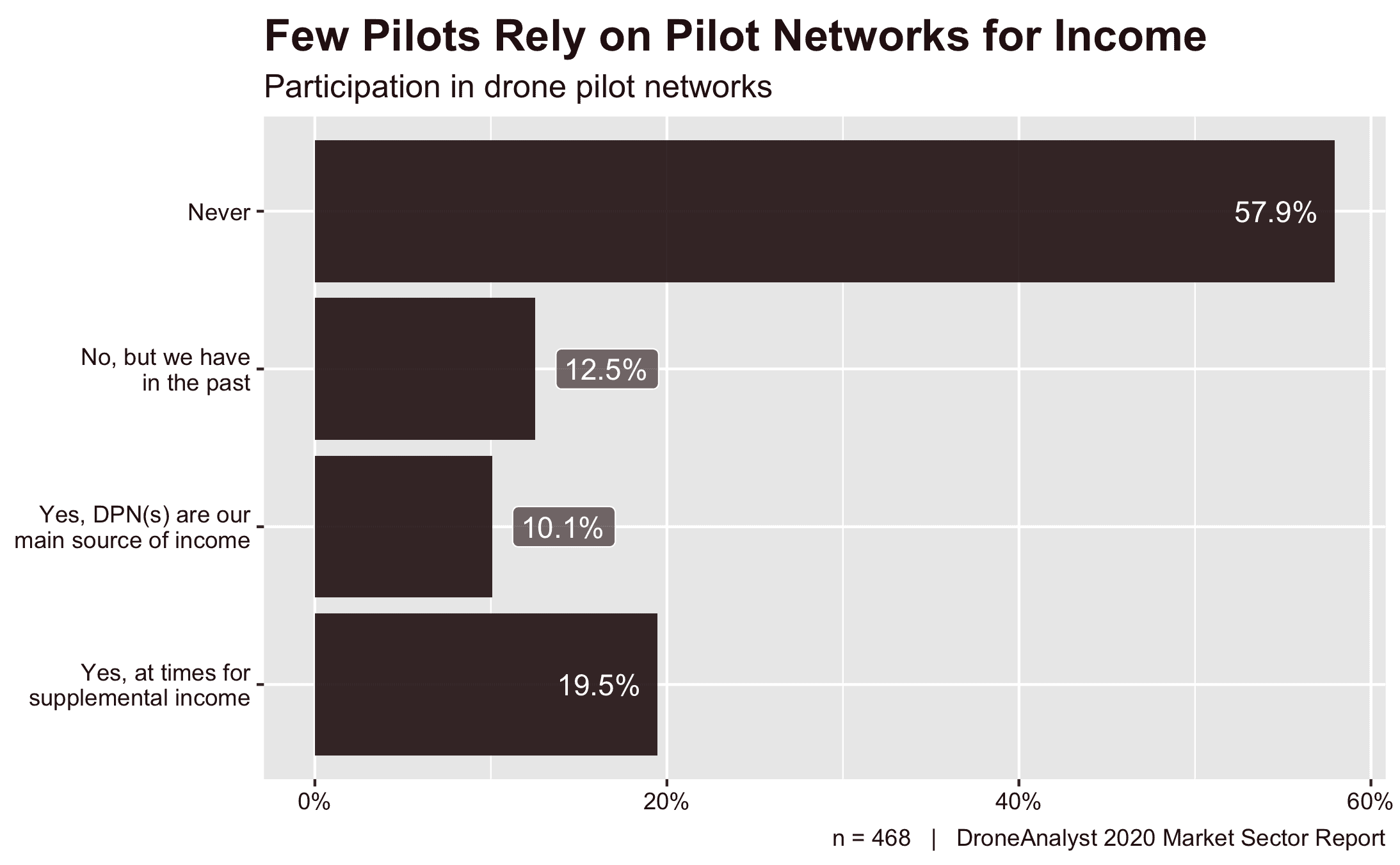

We have seen the rise of drone pilot networks like DroneBase, Droners.io and more where pilots can find jobs via an online marketplace. Starting with our 2020 survey, we began tracking the role these pilot networks play in driving revenues for commercial pilots. Discussions on online forums generally suggest that jobs offered through these networks are at such low prices, that they are helpful for getting experience, but not much else.

Our survey data suggests that this assessment is generally right, with pilot networks being a major source of income for just 10% of respondents, and supplemental income for another 20% of them.

Overall, if you are looking to start up as a commercial pilot, look at pilot networks as a starting point, but don’t rely on them for your core income. Additionally, we are seeing some structural shifts among these pilot networks, which is seen when we start cutting this data by how long the pilot has been operating, and others, but that is for another discussion.

Participate in the 2021 Survey

I hope this provided some transparency to service provider revenues, and what industries are the most lucrative for drone services. We are once again running our annual market survey and would love for you to participate and share your experiences. Participating will get you a summary of the findings and enter you for a chance to win a $400 gift card.

You can participate here: https://bit.ly/DASurvey_2021

Where to Find More Insights

- We calculate the size of the hardware drone market and recent financials from DJI and Parrot

- Dive into the new US Drone hardware ecosystem and trends among the US Military UAS fleet

- Learn how DJI’s drone dominance was born, the consumer market faltered and may rise again.

- Understand the four forces that shaped the drone industry in 2020.

Curious to know from where your source data is coming from

Hey George, it comes from our 2020 market sector report, which taps into over 1,300 qualified survey respondents. Specifically, we had 468 service providers answer the questions that we mentioned in this piece.