Key Takeaways from DroneAnalyst’s Fifth Annual Market Report

In this post, I’ll illustrate some of the market trends over the past year using data from our fifth Drone Market Sector Report and describe large shifts that have impacted the industry in 2021.

While the full report covers everything from purchasing factors to challenges faced by each industry, we broke the key shifts down into four key insights:

- Business and Agency Spending Surges

- Commercial Drone Hardware Market Shakeup Starts

- Services Revenues Reach Sustainable Levels

- Software Market Matures and Consolidates

The report and these findings are based on a survey of over 1,800 drone buyers, business and agency users and more, in conjunction with a series of stakeholder interviews and our own proprietary data. Overall we find the data to be a great sign for the industry, so let’s dive in.

Insight 1: Drone Program Spending Surges

Each year we have tracked closely how much business and agency users are spending on their drone programs. As many of these drone programs are recent adopters of drones, primarily rely on internal staff for operations and often use “consumer-grade” hardware, spending has remained low and often below $10K USD per year for the average business and agency user.

We are happy to report that we have seen large upward movement in spending this year, with more than half of all drone programs spending above this $10K USD mark. This has been the largest trend in driving the drone industry, and has had further ramifications on the brands purchased, drone types used and the revenues of service providers.

This growth is not equal across the board, and our report dives into nuanced trends among fleet sizes, staff counts and budgets across key sectors. The industry that stood well above the rest was the utilities space, where nearly half of firms spent over $50K USD, and many well above that amount.

Insight 2: Hardware Shakeup

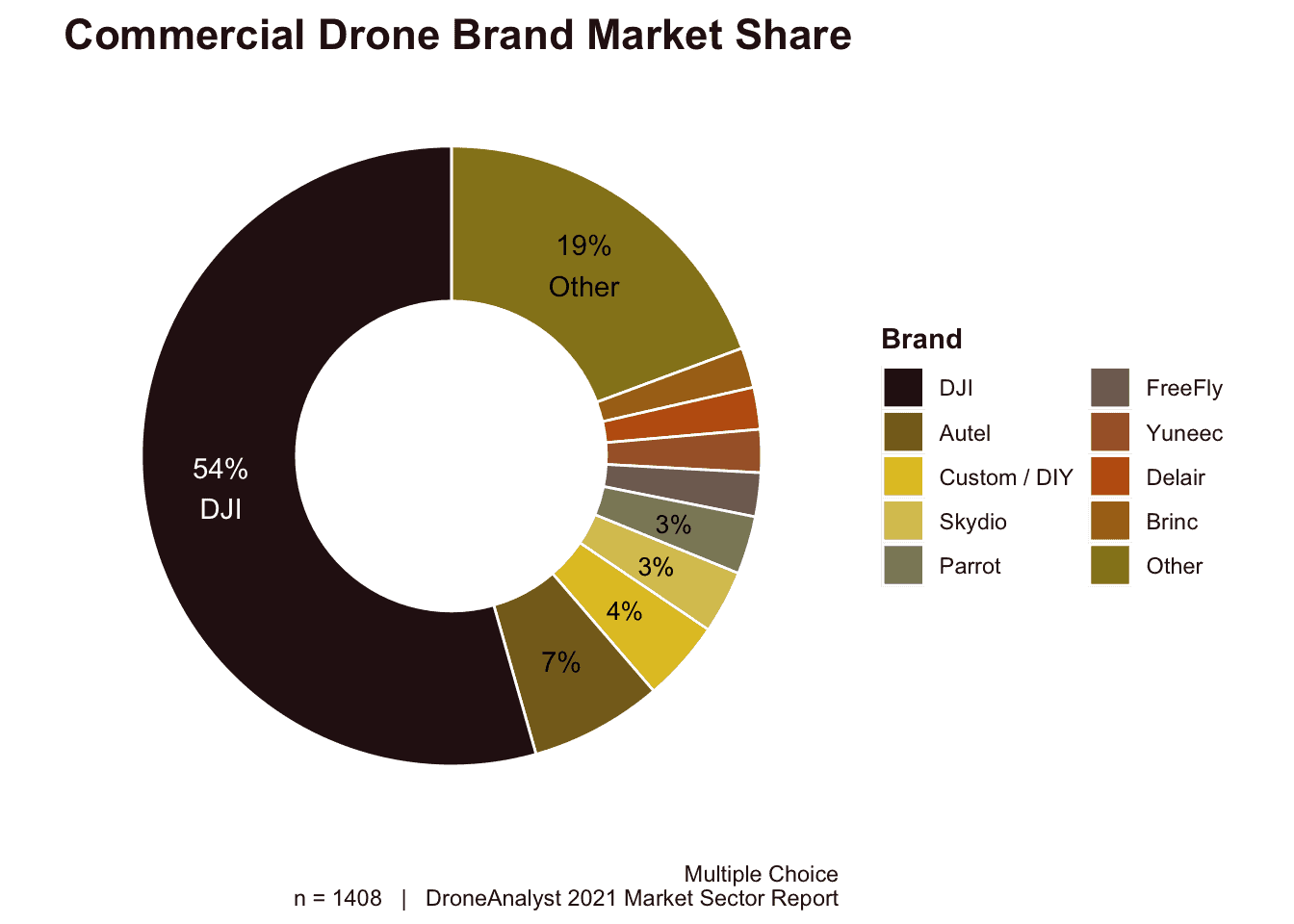

The recent history of the drone industry is also the story of the industry’s sole hardware champion, DJI. While they have always caught the eye of the media (for good and bad reasons), they have truly been the “main protagonist” of the industry. This is best captured in our historical market share data, which saw them capture 50% market share in 2016 before climbing to 72% in 2017 and eventually 74% in 2018. We captured them facing headwinds In our data last year, where they took a small dip down to 69% market share.

This year, DJI took a more substantial hit, moving down to make up 54% of all new commercial drone purchases, representing a 15-point dip.

This was through a multitude of forces, from a retrenchment of their market presence (diminished staff size, cancellation of events like AirWorks) to concerns around Entity List addition and a heating up of competition. Despite this, it is important to put things in context and note that their consumer market share remains above 94%, and is also where much of their revenue comes from. You can explore this aspect of the market better through our hardware report insights.

But who is taking over? The answer isn’t so obvious. Many will point to the surge from DJI’s Shenzhen neighbour, Autel Robotics, but things are more complicated. Autel’s focus on having products that are similar to DJI’s has led to short term growth, but their investment in a unique VTOL design will be a key indicator for whether or not Autel will have staying power beyond being a “DJI light”. Alternatively, Skydio remains towards the top with its push towards autonomy, and Brinc is the most interesting new player to enter the top 10 list with its hyper focused tactical drone.

It’s worth noting that Parrot was the only other brand to lose market share in this list, with huge growth in the vast array of brands that make up the Other category.

To better capture the commercial drone hardware market, we have portrayed this data in a treetop below grouped by each firm’s country of origin. Country of origin is determined by the location of each firm’s headquarters, and does not indicate anything about their supply chain.

Insight 3: Services Revenues Reach Sustainable Levels

Every year we have paid close attention to revenues from service providers as a key indicator for industry health. In previous years, we have seen revenues stagnate as new entrants flooded the market in its infancy to make it big in the drone industry. As many early drone services players have exited, and drone program spending has increased, we have finally seen this figure start to move upwards, making large strides.

2021 marks the first year that more than half of all services providers have made above $50K USD annually, a large rise from just 30% last year.

Insight 4: Software Market Matures and Consolidates

The drone software market has always remained more dispersed as firms turn to a variety of different software types and vendors to address needs varying from drone control and fleet management, to map generation and inspection. Often firms have even tested or owned multiple software with similar functions for specific workflows. However, this is changing as the market slowly consolidates around a few leading vendors. This is most notable in the Insights / Analytics software category, but is also the trend in the drone operations management category.

This consolidation is best captured by the fact that our top two paid software brands (DroneDeploy and Pix4D, in that order) now make up 27% of software purchases, up from 20% last year. The drone operations management space, however, continues to fluctuate and we’ve seen large movement in players, especially in specific industries.

Learn More with The Full Report

Our online survey garnered over 1,800 respondents with findings across drone purchases, business and agency users, service providers and software services. The report features 92 Figures and 7 Tables to uncover insights across these segments. We offer insights and analysis on:

- Who’s buying what types of drones from which makers at what prices and for what uses.

- How large the drone-based service providers are, and how they position themselves to their target industries.

- Who the business users of drone-based projects are, and which industries have traction.

- How much service providers, business users, and public agencies are using drone operations management and insights/analytics software, and the landscape of these software categories.

Where to Find More Insights

- We calculate the size of the hardware drone market and recent financials from DJI and Parrot

- Dive into the new US Drone hardware ecosystem and trends among the US Military UAS fleet

- Learn how DJI’s drone dominance was born, the consumer market faltered and may rise again.

- Understand the four forces that shaped the drone industry in 2020.