Drone industry likely to be the birthplace of leaders in the growing mobile industrial robot / uncrewed ground vehicle space

While the industry has set its sights on using the term “drone”, these devices are truly just another domain of uncrewed or robotic systems being deployed by industrial users. And often they’re the first adopted, as drones tend to be relatively affordable and mature in their capabilities.

We’ve seen a few industry leaders slowly crossing the boundaries between the drone and growing industrial robotics sector. This includes DroneDeploy’s acquisition of Rocos, a software platform for ground robots like Spot. Boston Dynamics themselves have hired several high-profile drone professionals and partnered with several drone resellers to bring Spot to market. Not to mention that while these resellers primarily sell drones today, names such as “Rocky Mountain Unmanned Solutions” (or RMUS) suggest they intend to have a broader role as other systems mature.

As larger enterprises automate more of their operations, they’ll need an array of robots across a variety of capabilities, form factors and domains. This opens an opportunity for OEMs, developers, service providers and resellers in the sUAS space to extend into other uncrewed domains.

But exactly how large is this overlap in the first place, and what types of other systems are these users adopting or testing out?

Drone programs adopting other uncrewed systems

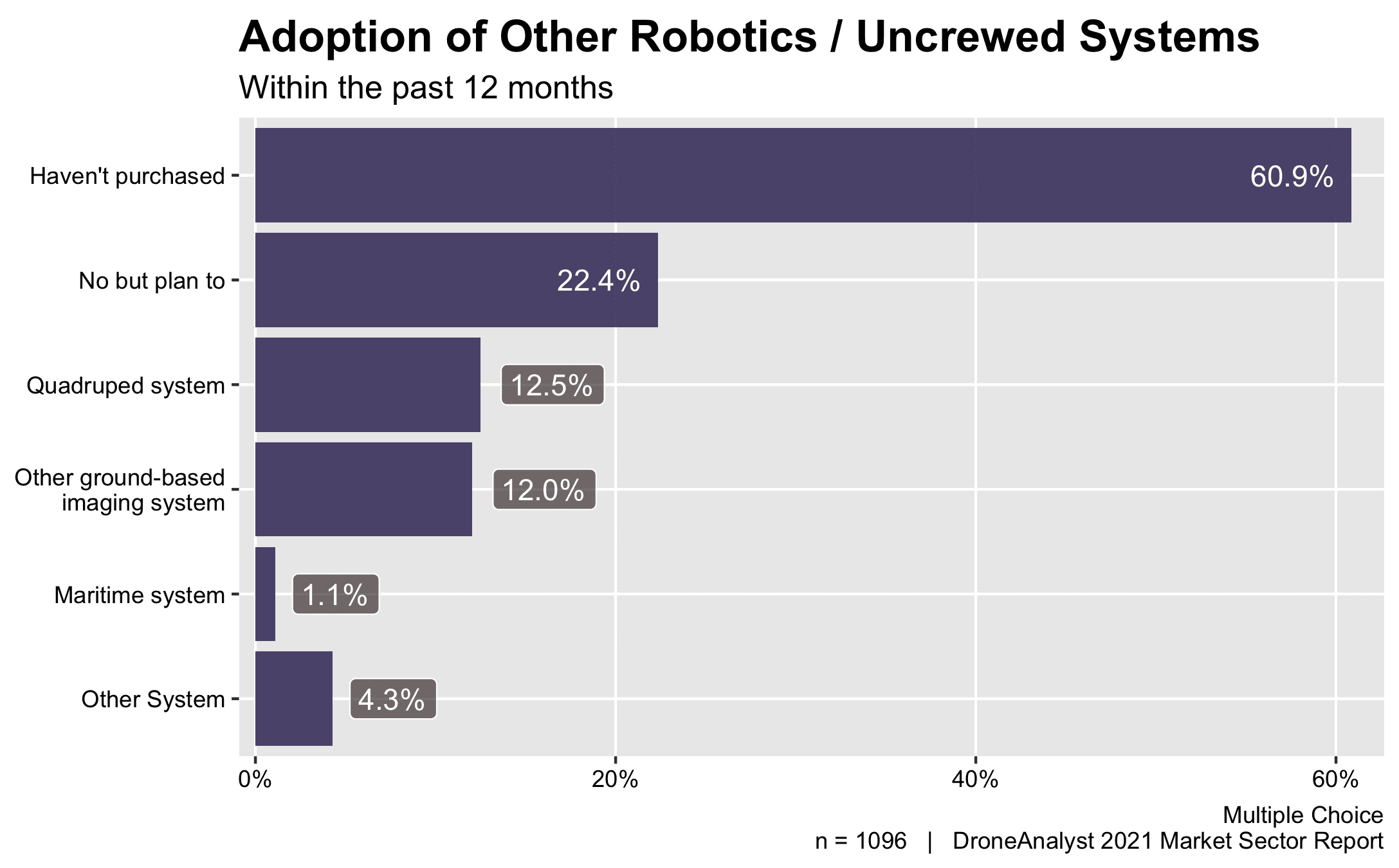

Through our larger efforts to uncover the drone industry trends, we surveyed over 1,000 business and agencies with active drone programs to identify adoption trends. One of the most interesting questions we added this year was around the purchase (or future intent to purchase) of other robotic or uncrewed systems over the past 12 months.

The findings show that while the majority (61%) of drone programs haven’t made the jump to other robotic systems, 22% have plans to and 17% have already purchased one (or more) type of robotic system.

While this is a low portion overall, considering the relative immaturity of other uncrewed systems, it signifies a likely overlap between the drone and future industrial robotics industry as they grow.

What systems are being purchased

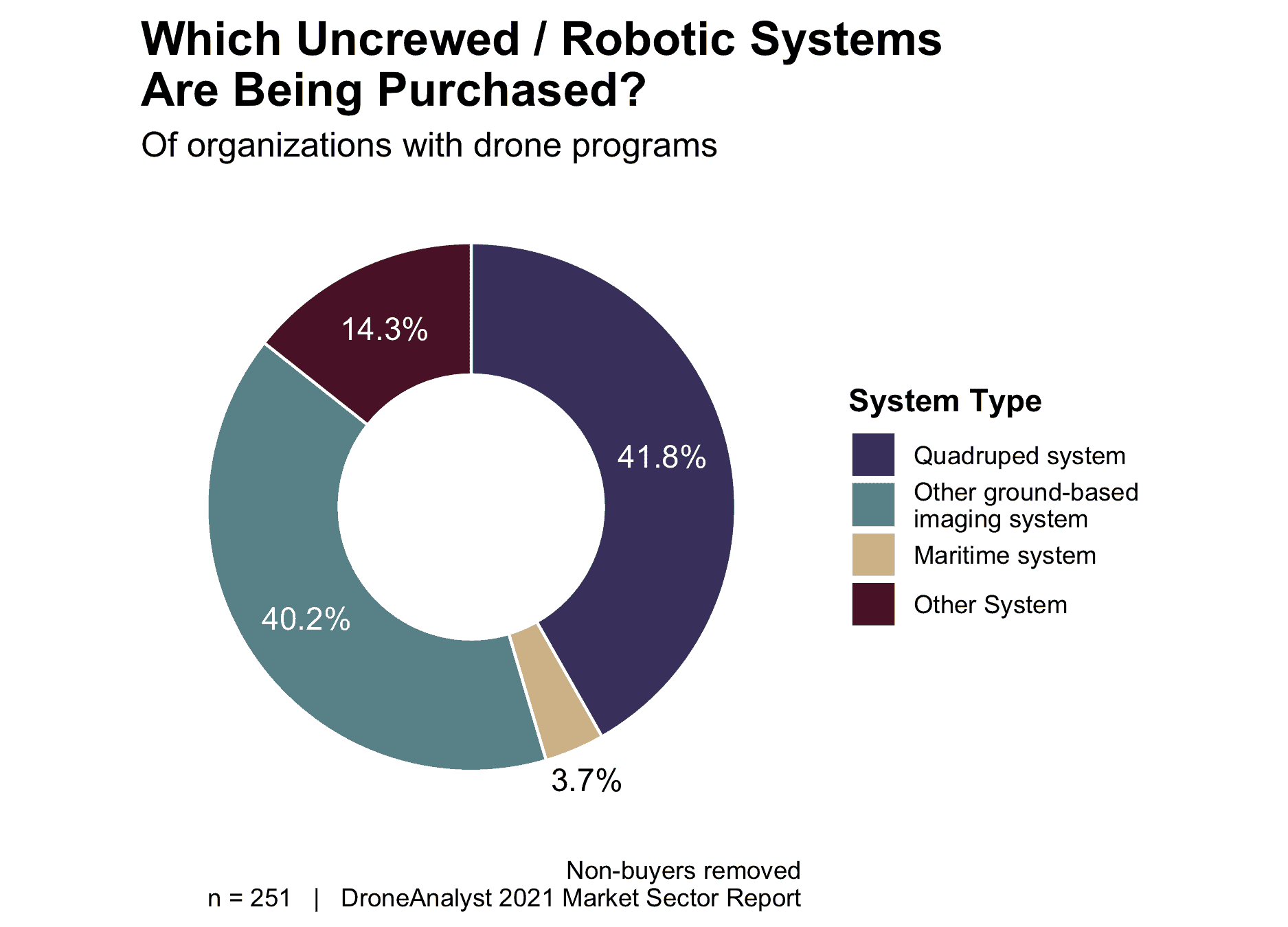

When we look just at those that purchased such systems, we find these purchases are overwhelmingly dominated by ground-based systems (82%) with most choosing a quadruped system such as the high profile Boston Dynamics Spot.

Other ground-based imaging systems include systems such as the snakebot, while maritime systems include devices such as unmanned sonar boats, rovers and more. Some notable systems among the “other systems” that respondents wrote in included TinySurveyor, various indoor laser guided vehicles (LGVs for short, mostly for warehouses), and more.

Which industries are most likely to adopt uncrewed systems?

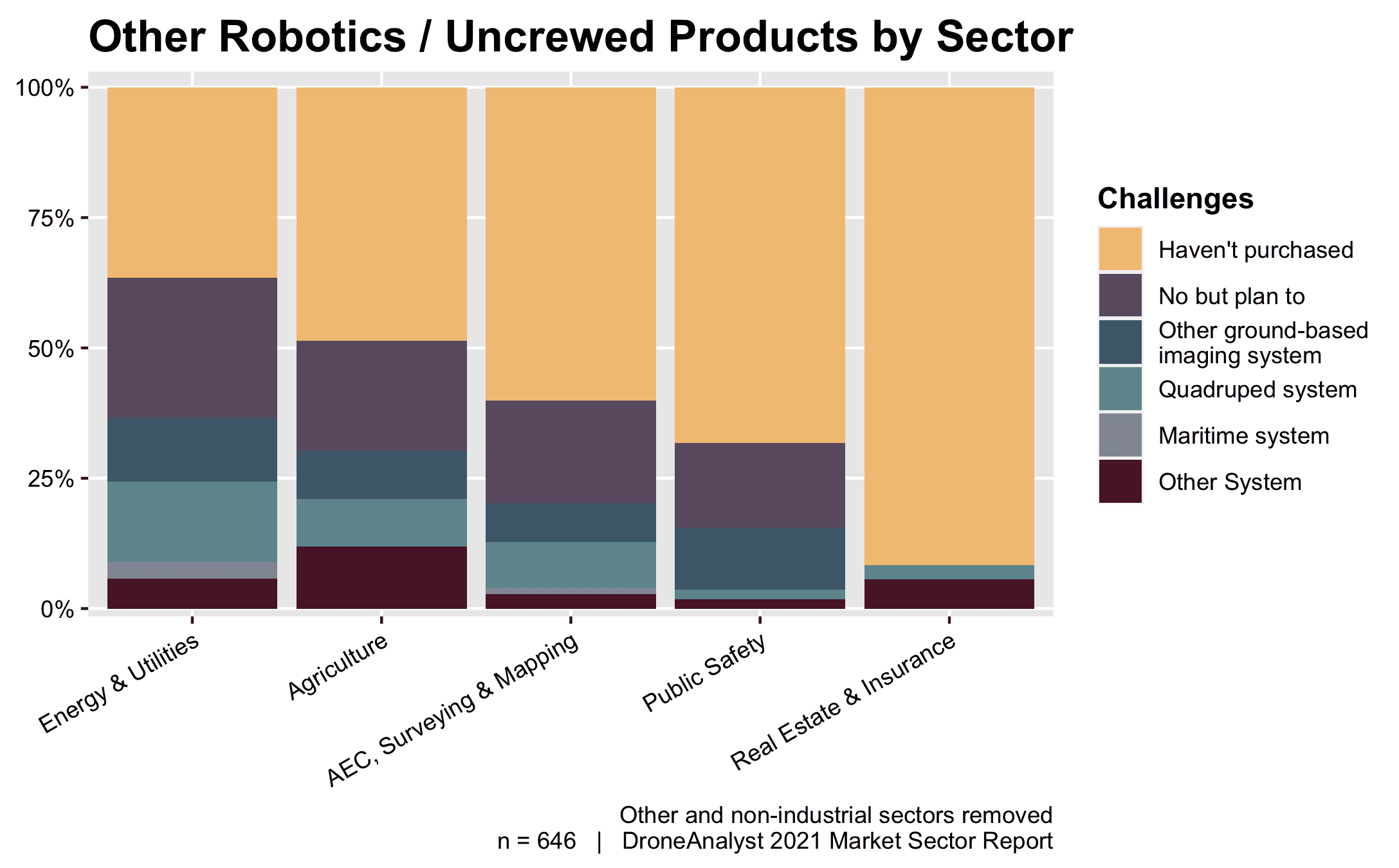

Among business and agencies with drone programs, we found huge gaps among those types of entities likely to adopt uncrewed systems and those that aren’t. When splitting behavior across key industrial sectors – energy & utilities, agriculture, AEC and surveying, public safety and real estate/insurance – we found intention to purchase other uncrewed systems ranged from as high as 63% among energy & utilities companies to just 8% among real estate and insurance firms.

This makes sense considering the economics behind use cases in each of these industries.

One of the notable surprises here is Agriculture, an industry that had high expectations for adopting drones earlier on, but has lagged behind in adoption across North America and Europe. This likely follows differences in geography, where a ground system may be preferred across expansive yet primarily flat land.

Where adoption is moving in the future

Our findings show adoption of other uncrewed / robotic systems exists, and we assume it is likely to grow in the coming years as more robotic systems reach maturity. Drone industry stakeholders will be smart to consider how they may be able to enter the broader industrial robotics market while business and agency users consider their need for uncrewed systems holistically instead of focusing on just a single domain. This means moving from “drone programs” or “drone program manager” to “robotics programs” and “robotics program manager”.

While certainly different form factors and capabilities are going to exist across industries and domains, large enterprises are going to want to keep some things similar across all robots they operate. Whether that be the control mechanism, point of sale, maintenance, system management or anything else will be determined by actions stakeholders across the industry take today.

Learn More with The Full Report

Our online survey garnered over 1,800 respondents with findings across drone purchases, business and agency users, service providers and software services. The report features 92 Figures and 7 Tables to uncover insights across these segments. We offer insights and analysis on:

- Who’s buying what types of drones from which makers at what prices and for what uses.

- How large the drone-based service providers are, and how they position themselves to their target industries.

- Who the business users of drone-based projects are, and which industries have traction.

- How much service providers, business users, and public agencies are using drone operations management and insights/analytics software, and the landscape of these software categories.

Where to Find More Insights

- We calculate the size of the hardware drone market and recent financials from DJI and Parrot

- Dive into the new US Drone hardware ecosystem and trends among the US Military UAS fleet

- Learn how DJI’s drone dominance was born, the consumer market faltered and may rise again.

- Understand the four forces that shaped the drone industry in 2020.