Service provider revenues trend upwards and a breakdown of the challenges these firms face

The rise of the services market and the “droneprenuer” is nothing new, with a sea of content and forums out there on how to start. Each year we like to distill findings on service provider revenues and where providers are making the most money (find last year’s article here). However, this year we’re changing things up, focusing more broadly on the annual trends and what challenges these service providers face.

The goal of this article is to paint a clearer picture for all industry stakeholders on the problems faced by service providers, movement of service provider revenues and more. All backed up by data from our 2021 survey of the market (FYI, our 2022 survey is live here).

Before we dive into our takeaways for the drone service provider (DSP) market, there are two key things to consider. The first is that service providers don’t operate in isolation, often relying on steady work from the business community. From our findings, business and agency spending on drones and drone related services has accelerated more last year than ever before, but they are also relying more frequently on internal pilots. The second is that a few of our datapoints separate out “sole proprietorships” which are literal one man service shops. While this is a large portion of our respondents, it’s not everyone and we’ve generally seen movement towards mid-sized DSPs.

Table of Contents 1. Service Provider Revenues Increase 2. Issues Inhibiting Service Provider Growth 3. Historical Look at Issues Faced by Service Providers

Drone Service Provider Revenues Increase

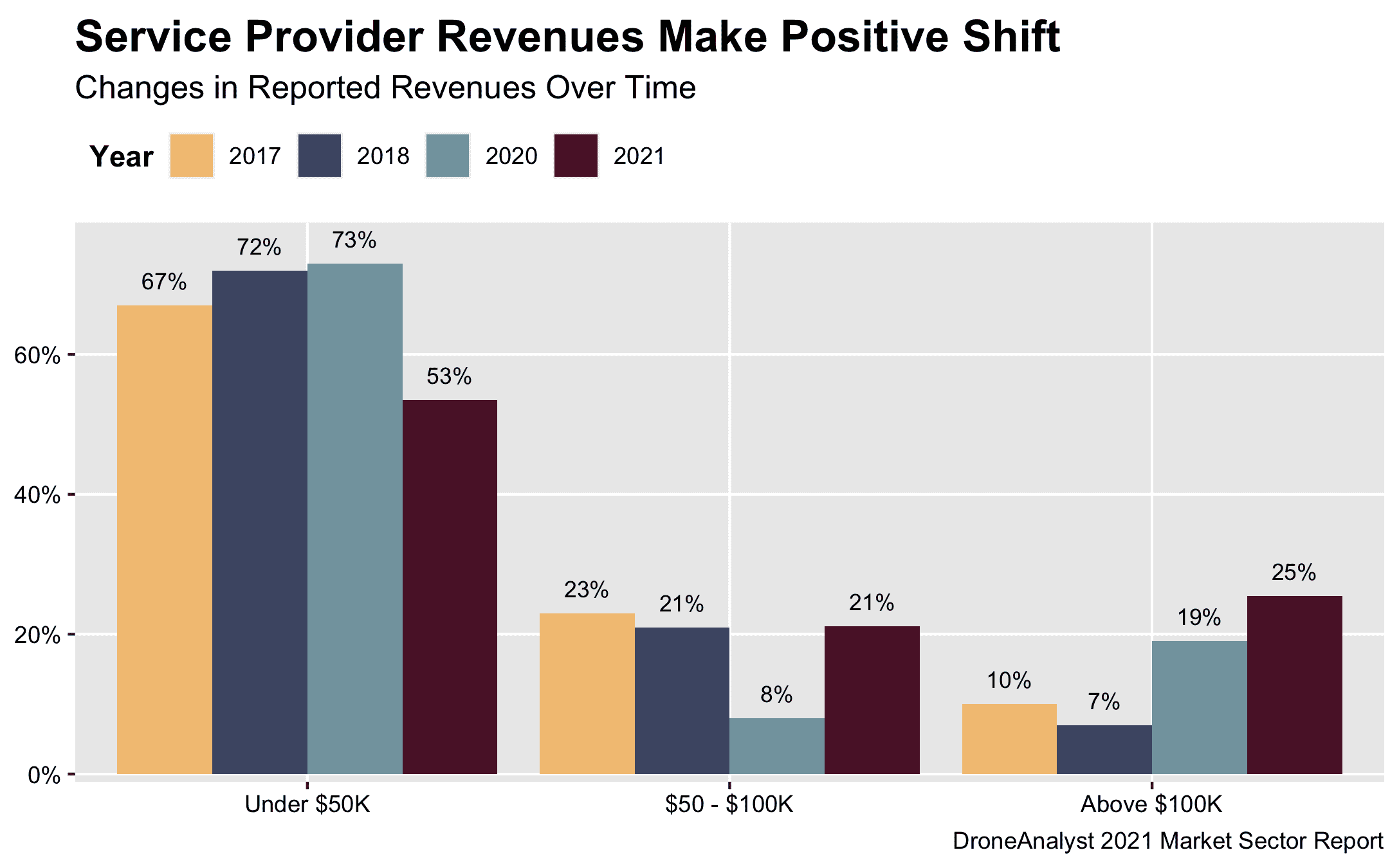

As early as 2017, we’ve been sharing survey results around service provider revenues. Historically, we’ve seen individual revenues (and therefore salaries) struggle to grow as the market was flooded with new entrants shortly after the Part 107 rules went into place. Now as the market has matured we’re seeing this race to the bottom end and revenues for service providers have made strong upward progress.

Below is a graph of this data for every year we asked about service provider revenues, and the trend among the “Under $50K” group tells the story the clearest with a 20 point drop as nearly half (46%) of providers made more than $50K USD.

From this we can see a fairly steady concentration of low service provider revenues before a large reversal in 2021. This reflects some larger trends captured in our 2021 findings, which we’ll summarize here:

- Exits from earlier players, often due to struggles to become profitable or moving to an in-house program. Compounded by the demand for more expensive hardware in specific verticals

- Increased business and agency spending on drone services (despite a smaller portion of them outsourcing), spurred by COVID-19 and the natural maturation of programs

- Service providers are overall getting larger. Our survey is still dominated by sole proprietors and teams smaller than 5, but we did see growth of larger service providers – albeit not enough to be the sole reason behind this trend reversal

Overall, this is a great sign of health for the services industry, and the broader drone market at large. As drone software and hardware becomes more sophisticated (and costly), service providers need justifiable revenues to cover these expenses.

Issues Inhibiting Service Provider Growth

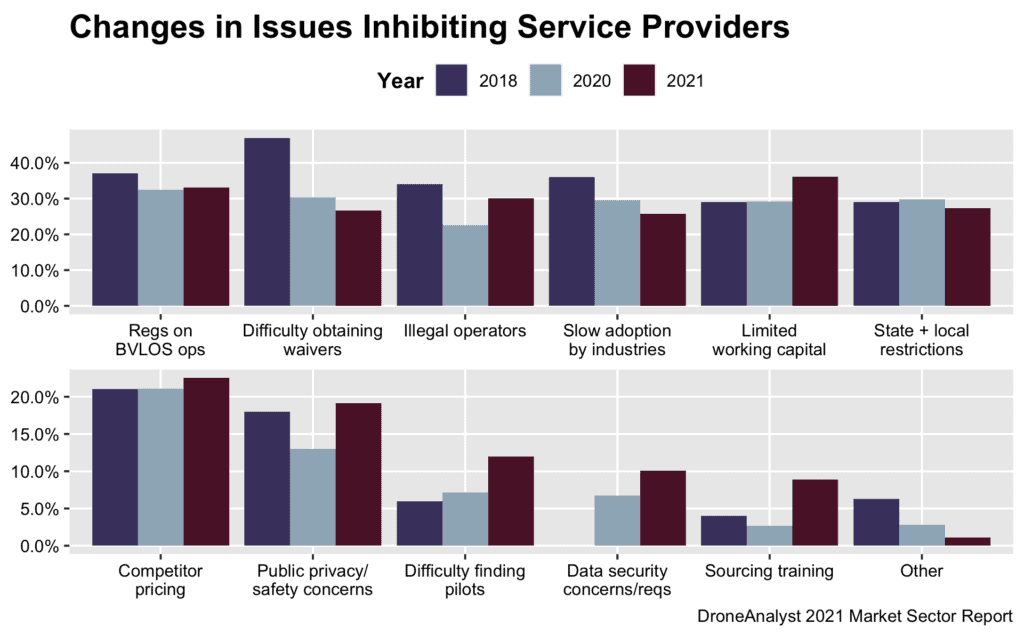

With a majority of service providers still making below $50K USD/year, what exactly are the issues these firms see as key blockers to their growth? Each year we’ve tracked key issues experienced by service providers. Below you can see how that breaks out for all service providers and sole proprietors.

For all service providers, 3 out for the 4 top issues encountered are related to regulations (illegal operators, BVLOS restrictions, state and local), despite the dominant issue being working capital. That becomes less pronounced when looking at sole proprietors, where they slow adoption rises as a key issue. That more likely reflects their struggle to add clients due to limited sales resources (just themselves).

Historical Look at Issues Faced by Service Providers

This becomes even more interesting and telling (especially around the impact and movement of regulations) when we zoom out and consider how service provider issues have changed over time.

When reading the below chart it’s important to note each row has a different scale for improved readability, with the lower row overall being less common issues. Data security concerns / requirements was added as an option in 2020.

On the regulation side, it’s telling that we saw a large decrease in concerns around obtaining waivers or clearances. This is largely due to efforts by the FAA & private industry on scaling LAANC and 107 waivers. With most movement happening on 107 waivers in the past two years.

Among business related issues, increased frequency of difficulty finding pilots, limited working capital and sourcing training as issues are also a sign that these mid-sized service providers are growing and hitting more common business issues.

Participate in the 2022 Survey

I hope this provided some transparency to service provider revenues, and the challenges faced by these firms. We are once again running our annual market survey and would love for you to participate and share your experiences. Participating will get you a summary of the findings and enter you for a chance to win a $400 gift card.

You can participate here: droneanalyst.typeform.com/22-survey