Drone Data Services

What Every CIO Needs To Know About Commercial Drone Data

This post first appeared on Forbes.com as Drones Pose A Unique Big Data Challenge For Business Users The public might consider them nuisances, but in the commercial market, drones are valuable data collection devices. Their primary task is to capture, store, and transmit data. So as IT departments consider integrating more drone data into existing enterprise … Read more

Measuring Success in the Drone Market

“If you can’t measure it, you can’t improve it.” – Peter Drucker The $118M Airware failure is a cautionary tale for all potential commercial drone investors—as well as all existing commercial drone market participants. To avoid such failure—whether you are drone aircraft manufacturer, software vendor, service provider, business enterprise, investor, or public agency—you need the … Read more

Top 40 Drone Data Services

In this August 2018 report, we list the top software applications and data services for processing drone images. This one-page report includes Vendor name Product name URL link to the website Read more about drone data services in 5 Tips for Evaluating Online Drone Data Services. Complete the form to get your free report … Read more

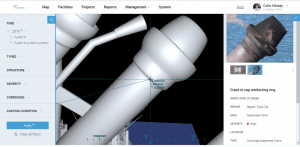

Is Sky-Futures Expanse Drone Inspection Software Good for All?

Sky-Futures cloud-based drone inspection visualization and reporting software squarely targets the asset inspection sector, but will it be broadly adopted? THE FACTS: No one questions whether the founders of Sky-Futures know what they are doing. When it comes to drone inspections they have “been there, done that.” You can read about their history and … Read more

DroneDeploy: Enterprise Grade or Not?

DroneDeploy’s new App Market fills a need for commercial drone use, but can the data quality measure up for widespread industrial use? THE FACTS: This past week, DroneDeploy introduced its new App Market, a store for drone applications from a range of companies—including Autodesk, Box, John Deere, and 13 others—as well as a variety of … Read more

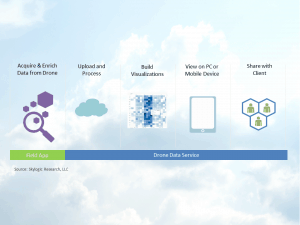

5 Tips for Evaluating Online Drone Data Services

Choosing the right service means choosing a trusted business partner THE FACTS: In early 2014, it was easy to see that drones themselves (the aircraft) would quickly become commoditized and their value would come not from what they could do but from the data they collect. In a piece titled “Drones Revolution Means Big Data … Read more