Purchase Our 2020 Drone Report

This 129-page research report pulls together our latest research on both the consumer and commercial markets to provide a holistic view of drone buyers, service providers, business and public agency users, and software service users, plus insights into the verticals that use drone services.

The report features 67 figures and 10 tables offering insight and analysis on:

- Drone and payload hardware brand market share, purchasing factors and purposes across commercial and consumer segments.

- Which business and agency users are purchasing drones, which industries are gaining traction fastest and spending the most on drones and related services.

- The size and nature of drone-based service providers, what markets they're targeting and the performance of large service networks.

- Attachment rate of various software types to different drone stakeholders, and the market share of software brands across drone operations management and insights/analytics software.

This report is broken down into Key Insights, Understanding Segments & Verticals and Detailed Findings.

Key Insights reveals the 10 most critical findings from the report that unveil larger shifts in the market.

Understanding Segments & Verticals provides a holistic view to each of the reports four key areas of focus - drone purchases, service providers, business and agency users and software services.

Lastly, the Detailed Findings section breaks down answers to the survey questions and key areas of focus one-by-one for a complete understanding of the market.

This report is based on two different forms of research: a quantitative online survey and qualitative phone interviews.

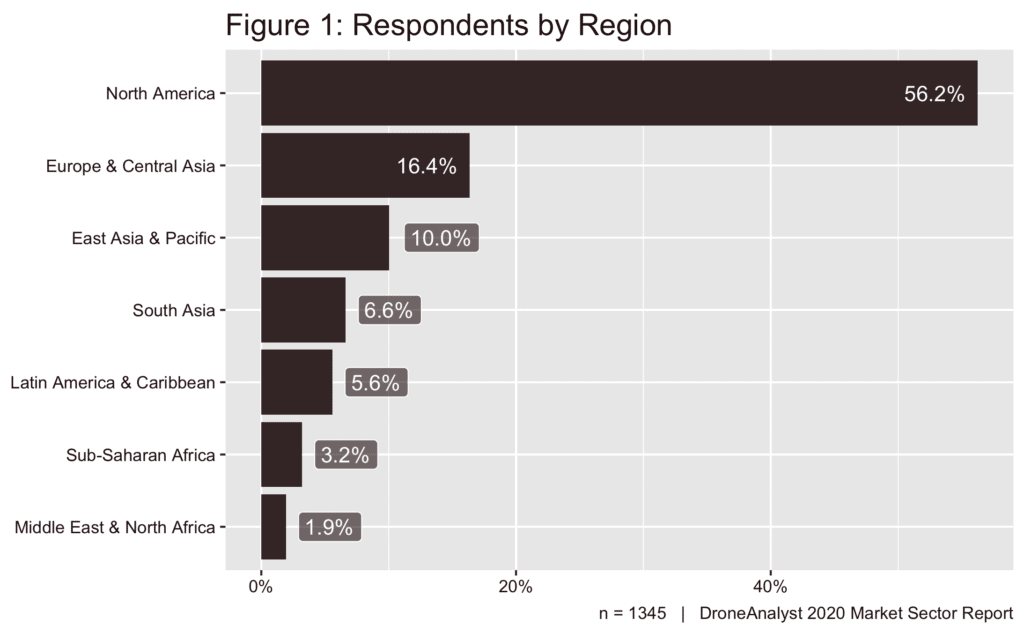

Our quantitative online survey collected responses from 1,345 drone industry stakeholders representing 39 industries and over 100 countries.

Respondents were mostly concentrated in North America (56% of responses), followed by Europe & Central Asia (16%), East Asia & Pacific (10%) and South Asia (7%).

Throughout the survey, we created several tests and loops to ensure that all counted respondents were at least one of the following: drone buyer, service provider, business and agency user or drone software user.

Our qualitative phone interviews were conducted across a 3-month span and focused on voices that were likely to be underrepresented in our survey - large enterprise drone programs and hardware/software vendors.

Figure 1: Respondents by Region

Figure 2: Respondents by Section(s) Answered

Figure 3: Respondents by Age

Figure 4: Industry / Sector of Respondents

Figure 5: Respondents by Role

Figure 6: Drone Aircraft Type Purchased

Figure 7: Drone Brand Market Share

Figure 8: Drone Brand Market Share by Country of Origin

Figure 9: Most Expensive Drone Purchase

Figure 10: Where Drones Are Purchased

Figure 11: Changes in Place of Purchase

Figure 12: Primary Purchase Objective

Figure 13: Primary Purchase Objective (Professional Use Only)

Figure 14: Changes in Professional Purchase Objectives

Figure 15: Hobby vs. Professional Use by Price

Figure 16: Camera and Sensor Integration Method

Figure 17: Sensor Type(s)

Figure 18: Sensor Brand Market Share

Figure 19: Add-on Payload Market Makeup

Figure 20: Other Mounted Accessories

Figure 21: Primary Purchasing Factors

Figure 22: Necessary Security Features

Figure 23: Impact of Security Claims About Chinese Products

Figure 24: Number of Years Offering Services

Figure 25: Changes in Duration Offering Services

Figure 26: Years of Services By Region

Figure 27: Revenue From Drone Operations

Figure 28: Number of Full- and Part-time Employees

Figure 29: Drone Projects per Year (Service Providers)

Figure 30: Primary 3 Services Offered

Figure 31: Training Methods Used (Service Providers)

Figure 32: Training Provider(s) Used (Service Providers)

Figure 33: Future Hiring Intentions (Service Providers)

Figure 34: Issues Inhibiting Growth (Service Providers)

Figure 35: Changes in Issues Inhibiting Service Provider Growth

Figure 36: Net Impact of COVID-19 (Service Providers)

Figure 37: The Effects of COVID-19 (Service Providers)

Figure 38: Impact of China Security Concerns (Service Providers)

Figure 39: Participation in Drone Pilot Networks

Figure 40: Pilot Network Share of Service Providers

Figure 41: Primary Mission of Drone Program

Figure 42: Number of Years Using Drones

Figure 43: Region / Years Using Drones

Figure 44: Program State

Figure 45: Drone Program Structure

Figure 46: Business and Agency Outsourcing

Figure 47: Business and Agency User Revenue

Figure 48: Number of Staff Involved in the Program

Figure 49: Drones Owned or Leased

Figure 50: Drone Projects Per Year (Business and Agency Users)

Figure 51: Preferred Training Method (Business and Agency Users)

Figure 52: Drone Program Founding

Figure 53: Program Founding / Age

Figure 54: Business and Agency Spend

Figure 55: Expected Spending Changes (Business and Agency Users)

Figure 56: Drone Program Challenges

Figure 57: Impact of COVID-19 (Business and Agency Users)

Figure 58: Software Type(s) Used

Figure 59: Software Consumption Preferences

Figure 60: Respondent Type / Software Consumption Preferences

Figure 61: Stakeholders with Access to Drone Data

Figure 62: Drone Operations Management Software Market Share

Figure 63: Software Category Maturity (Drone Operations Management Software)

Figure 64: Primary Purchasing Factors (Drone Operations Management Software)

Figure 65: Insights/Analytics Software Market Share

Figure 66: Software Category Maturity (Insights/Analytics Software)

Figure 67: Primary Purchasing Factors (Insights/Analytics Software)

Table 1: Change in Professional Use by Price Range

Table 2: Change in Reported Revenues Over Time

Table 3: Fleet Size and Revenues of Service Providers

Table 4: Flight Hours Per Project

Table 5: Top 10 Drone Services Making Over $100K/Year

Table 6: Top 5 Drone Services Outsourced by Business and Agency Users

Table 7: Top 5 Drone Service Providers Globally, By Quantity of Services Performed

Table 8: Flight Hours Per Project

Table 9: Top 5 Business and Agency Drone Spenders, By Primary Mission

Table 10: Attachment Rate By Software Type and Respondent Type

This report covers a vast array of vendors and brands across the drone industry. Particularly, in our market share metrics we assessed the position of over 100 brands across the drone hardware, payload developer, service provider and software segments.

Just a few of the companies mentioned are listed below:

- 3D Robotics

- AirMap

- Autel

- Auterion

- DJI

- DroneBase

- DroneDeploy

- Esri

- FLIR

- Flyability

- FreeFly

- Inspired Flight

- KittyHawk

- Parrot

- Pix4D

- Sentera

- Skydio

- Skyward

- Teal Drones

- Wingtra

- Yuneec

- senseFly

This year's report was more representative of the global drone market than any of our prior reports. While our previous reports were predominantly centered around the North American market, this year we collected data across 110 countries, with the largest increase from Europe & Central Asia, East Asia & Pacific and South Asia.

A breakdown of respondents by region is shown below. We discuss the growth trends across these regions further in the report.

DroneAnalyst firmly believes that our annual market sector reports provide the best look at inter-market drone trends, position of vendors/stakeholders and near-term opportunities in the market. This is based on our approach in collecting large sample survey data, and relying on our historical data to unveil trends in the young industry.

This 2020 Report incorporates 1,345 survey responses and, following results for a worst-case 50-percent answer for a population of 15 million or greater, achieved a confidence level of 99% with a margin of error (MoE) ± 3.5.

DroneAnalyst has performed a similar data collection and analysis process since 2016, resulting in not just a more informed report, but a report that can capture critical historical trends in this young drone market. That can often be critical to understanding the position a particular stakeholder (or group of stakeholders) holds in the market.

An Enterprise License authorizes the entire population of a business or public entity (employees, on-site contractors, off-site contractors) access to the purchased report for up to two years from the date of purchase. The Enterprise License does not authorize resale or redistribution of our reports.

DroneAnalyst is aware that research and insights can often be unaffordable for young companies. With that in mind, we do have discounts available.

To learn more about any discounts for your organization, email david@droneanalyst.com.

DroneAnalyst does not handle your purchase directly, but instead relies on a secure 3rd party (Gumroad) to both securely handle your payment information and deliver the report.

Gumroad secures all payments through TLS, a higher grade security than SSL, with 128-bit encryption and using SHA2 cyphers. Neither DroneAnalyst nor Gumroad ever actually store your payment details. You can learn more about how Gumroad secures your payment information here.

Once a purchase is made, you'll get an email that provides access to the report. The report can be downloaded, read or printed in an A4 and/or US Letter size format. Each report is digitally stamped to prevent actions that may void the report's license.

The platform will also send you a receipt and can generate an invoice if needed for corporate reimbursements.

Have more questions about the report or looking to commission custom research based on our dataset? Email david@droneanalyst.com