Aerial Inspections

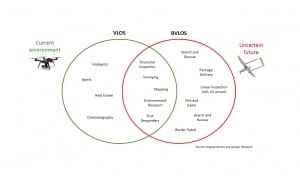

Evaluating the Economics of BVLOS Drone Operations

We just announced the release of our latest research on commercial drone operations. The Economics of Using Drones for BVLOS Inspections is a white paper sponsored by PrecisionHawk, the leading provider of drone technology for the enterprise, which provides a foundation for businesses to evaluate when it’s best to use traditional ground and manned aviation, … Read more

Drones in Public Infrastructure: Quick Start Guide

We’ve just announced the release of our Quick Start Guide to Drones in Public Infrastructure. This new report is the third and final series of white papers we’ve done to provide a complete primer to drone use in specific industries. The report consolidates our best insights into the challenges and solutions drones add to inspecting … Read more

Quick Start Guide to Drones in Energy

I’m happy to announce the release of our Quick Start Guide to Drones in Energy. This report is the second in a new series of Skylogic Research white papers, intended to provide a complete primer to drone use in specific industries. This year, we are building on the analysis we did for the 2017 Five … Read more

Five Valuable Business Lessons about Drone Inspections

We just released a new research report titled “Five Valuable Business Lessons About Drones in Asset and Infrastructure Inspection” This is the fourth in a series of white papers intended to share lessons learned in specific industries and how to maximize the value drones can deliver in those industries. This year, we are building on … Read more

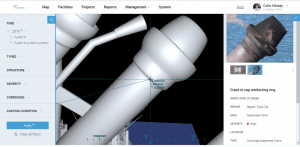

Is Sky-Futures Expanse Drone Inspection Software Good for All?

Sky-Futures cloud-based drone inspection visualization and reporting software squarely targets the asset inspection sector, but will it be broadly adopted? THE FACTS: No one questions whether the founders of Sky-Futures know what they are doing. When it comes to drone inspections they have “been there, done that.” You can read about their history and … Read more

The Truth about Drones in Construction and Inspection

We just released a new research study titled “The Truth about Drones in Construction and Infrastructure Inspection.” The free report is the second in series of studies sponsored by BZ Media that looks objectively at each major commercial market for drones and drone technology. In the report, we show how drones have been used successfully … Read more