Precision Agriculture

The War is Not Over: Why Agriculture Drones Deserve a Closer Look

As many of you know I’ve been researching and writing about agriculture drone solutions since early 2012. I recently came across this OpEd in PrecisionAg titled “Opinion: The Agricultural Drone War Is Over, And They Lost” and read it with great interest. Two and half years ago, our research indicated the same thing—that small drones … Read more

Can AeroVironment Compete in the Commercial Drone Market?

AeroVironment’s new drone and cloud-based analytics platform squarely targets the commercial sector, but are they targeting the wrong vertical, too late in the game? THE FACTS: Earlier this month, the military and tactical unmanned aircraft systems manufacturer AeroVironment (NASDAQ:AVAV) proudly unveiled its new QuantixTM drone and a cloud-based analytics platform called the AeroVironment Decision Support … Read more

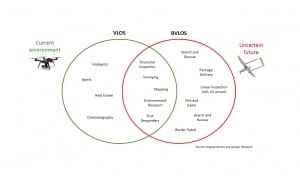

Commercial Drone Markets: 2014 Year in Review

Judging by the headlines, 2014 turned out to be the year for drones. I referenced in Tweets a total of 503 articles with the word ‘drones’ in the headline last year. A Google search brings up about 61.4 million results referring to ‘drones.’ Granted, that search includes references to military and hobby drones, but it … Read more

Five Reasons the AUVSI Got Its Drone Market Forecast Wrong

My guest blogger is Mitch Solomon of Aironovo and this is an excerpt from his post which we developed together. You can find his post here. —- Since its publication in early 2013, AUVSI’s The Economic Impact of Unmanned Aircraft Systems Integration in the United States has become the gold standard forecast for the commercial drone … Read more

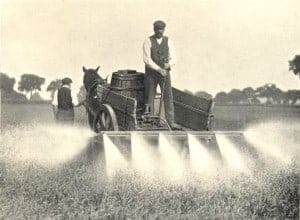

Film or Farm: Which is the Bigger Drone Market? – Part 2

This is Part 2 in a two-part series that summarizes my views on why video/film/cinema – not agriculture and farming — will be the largest driver of sUAS commercial businesses. In Part 1, I explore thoughts on the market for video/film/cinema, and below I outline why I believe agriculture will lag in market uptake. The … Read more

Film or Farm: Which is the Bigger Drone Market? – Part 1

This is Part 1 in a two-part series that summarizes my views on why video/film/cinema – not agriculture and farming — will be the largest driver of sUAS commercial businesses. In this part I explore thoughts on the market for video/film/cinema, and below I outline why I believe film and video will lead in market … Read more